More than half of bitcoin (BTC) addresses are still in profit, raising questions about the seriousness of the current “bear market”.

Data from on-chain analytics firm Glassnode confirmed that as of June 20, 56.2% of addresses were still worth more than their coins were entered in US dollar terms.

Profitability did not match previous market bottoms

As BTC/USD plunged to a 19-month low of $17,600 over the weekend, analysts see a 84.5% retracement from its all-time highs.

Confusion prevails this year with the “high not quite” relative to the historical bull market tops.

The subsequent decline has taken many by surprise, despite not matching previous bear markets.

Glassnode’s statistics support that idea. BTC price bottom has a tendency to coincide with less than half of the addresses remaining in gains, and as such, the current downtrend still has a way to go if it is to fit in with the historical pattern.

For example, in March 2020, profitable addresses fell by 41%, and before that, the 2018 bear market also saw a drop below the 50% mark.

However, panic may have already set in. As Cointelegraph reported, losses were felt to be mounting among holders, who are now uneasy about babysitting their funds.

The largest on-chain realization in bitcoin’s history occurred on June 13, reaching $4.76 billion in a 24-hour period.

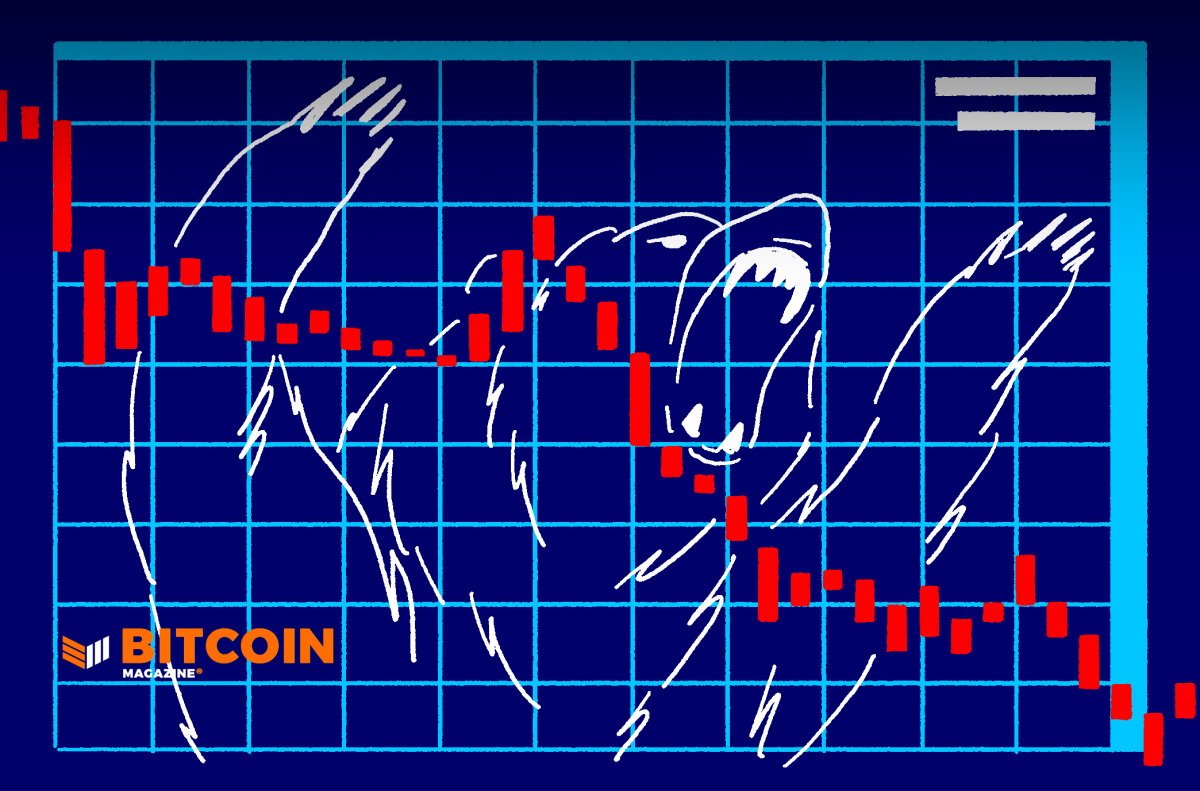

The market is “getting closer” to the big short

On the topic of how much selling is needed before a market reversal, Dylan LeClair, senior analyst at UTXO Management, looked at the divide between retail and derivatives traders.

RELATED: $19.2K . BTC price hits 3-day high as new whales form support

As time goes on, he argued this week, retail has sold out first, and speculators have come to round out the process by shorting BTC to unnaturally low levels.

“Getting closer,” is part of a tweet summarized with a chart showing the cost of shorters rising as price action eases in recent days.

The Down Is When the Derivatives Market Is Shorting $BTC In the mess after bearing the brunt of the sale on the spot.

getting closer… pic.twitter.com/HfDDflu06D

— Dylan LeClair (@DylanLeClair_) June 20, 2022

LeClear said more liquidations may be needed in the DeFi space before it can be put into a certain bottom.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, so you should do your own research when making a decision.

![🚦[ETH] THE GOOD AND BAD NEWS FOR ETHEREUM RIGHT NOW……CRYPTO CRASH UPDATE & PRICE PREDICTION!](https://i.ytimg.com/vi/eR2QNSCaxRA/maxresdefault.jpg)