Avalanche (AVAX) has faced 16% rejection from the $30.30 resistance level, after an impressive 73% rally between July 13 and August 13. Some analysts would try to point to the improvement as a “technical adjustment,” but the network’s deposits and decentralized applications reflect a worsening situation.

To date, Avalanche is down 83% from its November 2021 all-time high of $148. More data than technical analysis can be analyzed to explain the 16% price drop, so let’s take a look at the usage of the network in terms of deposits and users.

The decentralized application (dApp) platform is still a top-15 contender with a market capitalization of $7.2 billion. Meanwhile, Solana (SOL), another proof-of-work (PoS) layer-1 platform, has a market cap of $14.2 billion, nearly double that of Avalanche.

Avalanche’s TVL drops 40% in 2 months

Some analysts attach great importance to the Total Value Locked (TVL) metric and although it may be relevant to the decentralized finance (DeFi) industry, it is rarely used for non-fungible token (NFT) mints, digital item marketplaces, crypto games. Necessary. , gambling and social applications.

Using Layer-2 Solution Polygon (MATIC) as a proxy, it currently has a TVL of $2.2 billion, while MATIC has a market cap of $7.2 billion, thus a 3.3x MCap/TVL ratio. Curiously, the same ratio applies to Avalanche, which currently has a TVL of $2.2 billion and a capitalization of $7.2 billion.

Avalanche’s primary DApp metric began to show weakness in late July after TVL dropped below 110 million AVAX. In two months, the current 85.4 million is a sharp cut of 40% and signs that investors are withdrawing coins from the network’s smart contract applications.

The chart above shows how Avalanche’s smart contract deposits reached 175 million AVAX on June 13, followed by a steady decline. In dollar terms, the current TVL of $2.2 billion is the lowest number since September 2021. According to data from Defilama, this number is 8.2% of the total TVL (excluding Ethereum).

Initially, the data looks disappointing, especially considering Solana’s network TVL has a 27% drop over the same period in terms of SOL, and Ethereum’s TVL has a 33% drop in ETH deposits.

The use of dApps has also weakened competing chains.

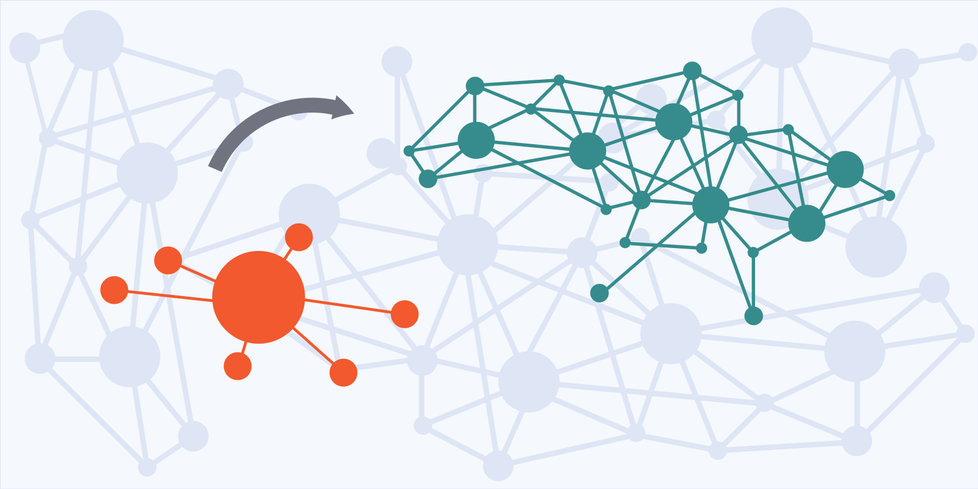

To confirm whether the TVL drop in an avalanche is troublesome, one must analyze some DApp usage metrics.

As shown by DappRadar, on August 18, the number of Avalanche network addresses interacting with decentralized applications dropped by 5% compared to the previous month. In comparison, Ethereum registered a growth of 4% and Polygon users increased by 10%.

Avalanche’s TVL has been hit hardest compared to similar smart contract platforms and the number of active addresses interacting with most dApps has crossed 20,000 in just one case. This data should be a warning sign to investors betting on this automated blockchain execution solution.

Polygon, on the other hand, racked up 12 decentralized applications with 20,000 or more active addresses in the same time period. The above findings suggest that the avalanche is losing ground versus the competitive chain and this adds further reason for the recent 16% sell-off.

The views and opinions expressed here are those of Author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should do your own research when making a decision.