Despite its shaky start, Uniswap v3 volumes have surged propelling the decentralized exchange (DEX) into second place, behind its v2 iteration.

Since its launch on May 5, the third form of Uniswap has grown significantly in terms of weekly trading volumes.

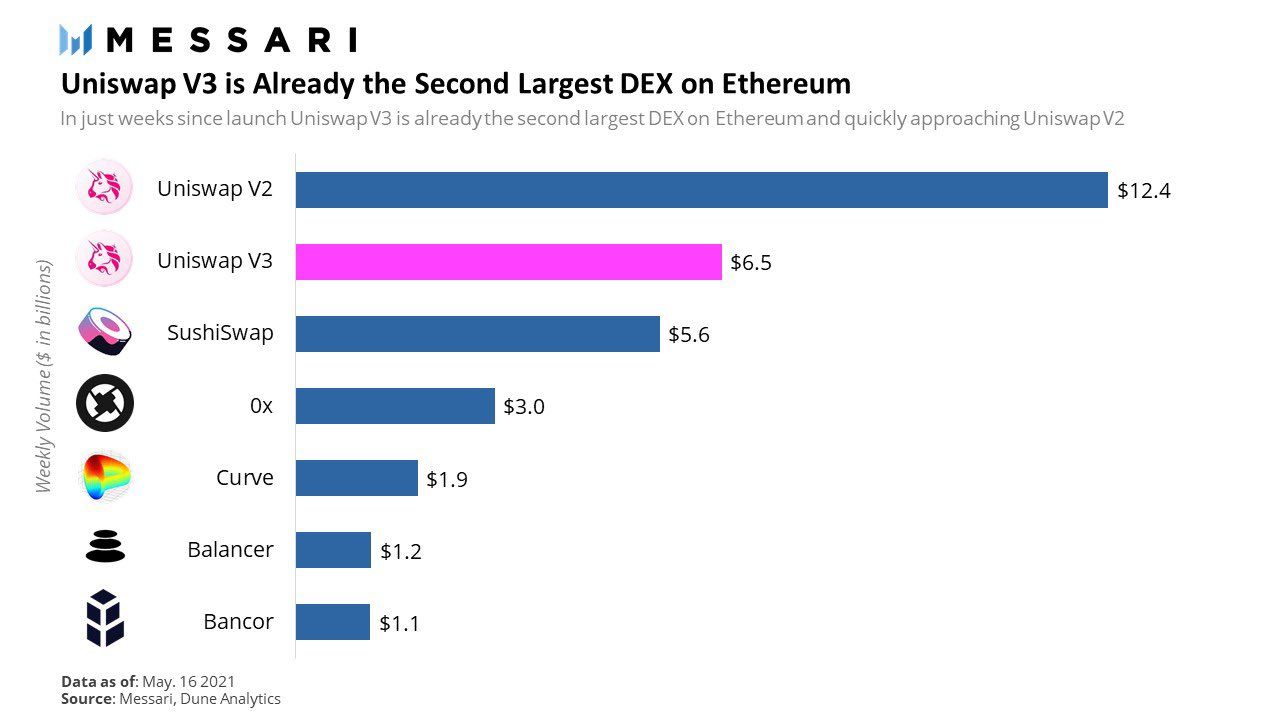

The DEX has now surpassed SushiSwap according to Messari data and is the second-largest on the Ethereum network with a weekly volume of $6.5 billion. Uniswap v2 is still the leading Ethereum-based DEX with almost double that at $12.4 billion per week.

The monumental growth was noted by Messari researcher Ryan Watkins who predicted:

“At its current pace of growth it will likely surpass V2 in volume by end of month. And the most impressive part about it, is V3 is doing so with a fraction of the capital.”

Battle of the DEXes

SushiSwap, which was once above Uniswap, is now the third-largest DEX according to those stats, with $5.6 billion traded per week. In terms of total value locked, a value that has slumped across the entire DeFi sector alongside the market crash, Uniswap has around $5 billion compared to $3 billion on SushiSwap according to DeFi Pulse.

Watkins noted that Uniswap v3 reached 81% of the volume of Uniswap v2 on May 19. It’s facilitating nearly as much volume as version 2 with less than 15% of the TVL.

“This is all without liquidity incentives, passive LP managers, or even its soon to come layer-2 deployment.”

He added that it’s the only automated market maker (AMM) that turns over its TVL more than 100% on a daily basis, more than five times that of Uniswap v2.

Immediately after launch, Uniswap v3 was labeled a ‘Uniflop’ by many due to the complexity of certain operations and the fact that gas costs were in some cases higher than version 2. The platform appears to have shrugged off this early negativity and still managed to attract collateral and traders.

The early success of Uniswap v3 plus the continued dominance of v2 has led to the platform increasing its market share to a new 2021 high of 61%, Watkins added.

UNI price update

Unfortunately, the positive figures have not prevented UNI from sliding further in line with the rest of the crypto market. The DEX governance token has lost 18% over the past 24 hours in a dump down to $25, its lowest price since the first week of March.

UNI has now collapsed 42% from its all-time high of $43 on May 3 as the massive cryptocurrency selloff continues.