In the last few years, decentralized exchanges (DEXs) seemed to be a flash in the pan against the huge growth seen by giants like Coinbase and Binance. 2020, on the other hand, is a whole new landscape, and decentralized exchanges like Uniswap are enjoying a massive increase in trading volume.

Uniswap, a leading DEX, just hit a record high for 24-hour volume.

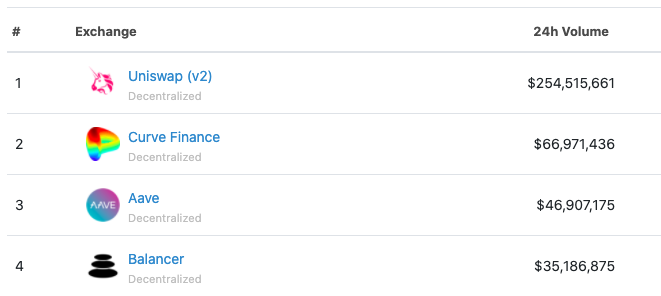

Uniswap’s market share has been growing rapidly in the past several months. According to CoinGecko data, Uniswap did $254M in volume in the past day—nearly four times higher than the next closest decentralized liquidity pool.

The surging volume is predictable if you’ve been following the buzz. On Aug. 9, Hayden Adams, the founder of Uniswap, Tweeted that exchange was processing over 100,000 transactions per day. This was followed by the announcement of the volume spike:

"Okay can you guys stop trading"

🤯 $250M 24h volumehttps://t.co/GYzcuJc9d3 pic.twitter.com/8TUqzmb0Dx

— Hayden Adams 🦄 (@haydenzadams) August 10, 2020

The growth makes sense when considering that Uniswap is where many DeFi tokens are first listed and is a primary source of liquidity for many new Ethereum-based tokens.

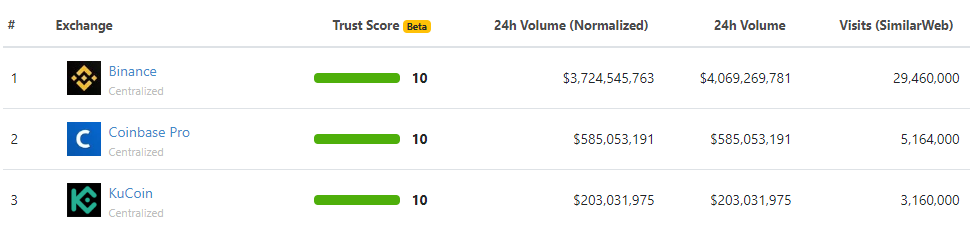

Uniswap’s total volume puts it in a position to start rivaling some of the larger, centralized exchanges. At the time of publishing, Uniswap’s volume rivaled some of the top-rated centralized cryptocurrency exchanges, beating out KuCoin by a hefty margin and matching nearly 45% of the 24H volume on Coinbase Pro.

Whether Uniswap can sustain these volumes has yet to be seen. The data does suggest that DEXs could return to dominate the ETH asset market sooner than many may have expected.

This development is also notable considering how underdeveloped decentralized exchanges are, and how much room for improvement there is from a UX perspective.

#Uniswap has done $193 MILLION in volume over the last 24 hours.

Just wait until the 80% of you figure out how to use it.

— 𝐁𝐮𝐥𝐥𝐫𝐮𝐧 𝐆𝐫𝐚𝐯𝐚𝐧𝐨 (@Bullrun_Gravano) August 11, 2020

This news comes in the wake of Uniswap’s announcement of an $11 million Series A funding round led by Andreessen Horowitz.

These kinds of developments are likely to increase regulatory attention, and perhaps this is when the real test will begin.