Planet Finance is a decentralized finance (DeFi) protocol with an aim that is out of this world. The protocol wants to bring DeFi to one billion users.

Built on the Binance Smart Chain (BSC), Planet Finance offers its users an array of decentralized apps (dApps) also referred to as ‘planets’.

Planet Finance in a nutshell

- DeFi protocol

- Built on BSC

- Planets = dApps

- Planet Finance’s audit with Halborn

- Four planets in existence: Blue, Red, Uranus, and Green.

- One planet in development: Pink.

- Current services offered: yield farming, vaults, liquidity pools, lending/borrowing

- Future services: NFT marketplace

About Planet Finance

Planet Finance has four services currently available and more that are in development.

The services, or Planets, include stablecoin aggregation, yield farming, and a lend/borrow protocol. An NFT marketplace will be launching soon.

Planet Finance is built on BSC to leverage the low fees and transaction speeds that this chain offers. The protocol has zero team tokens and no VC funding, making it a truly decentralized project built for the DeFi community.

$AQUA and $GAMMA

Planet Finance has a dual token model. $AQUA is the limited-mint governance token. Planet Finance has recently launched $GAMMA as the protocol’s general utility token.

Both AQUA and GAMMA are utility-based cryptocurrencies designed to accrue value and govern the planets. Both AQUA and GAMMA are in limited supply.

Having minted the max supply of 100,000 $AQUA Planet Finance has now started burning AQUA daily with protocol fees, notably having burnt over 300 AQUA within the first week.

The planets explained

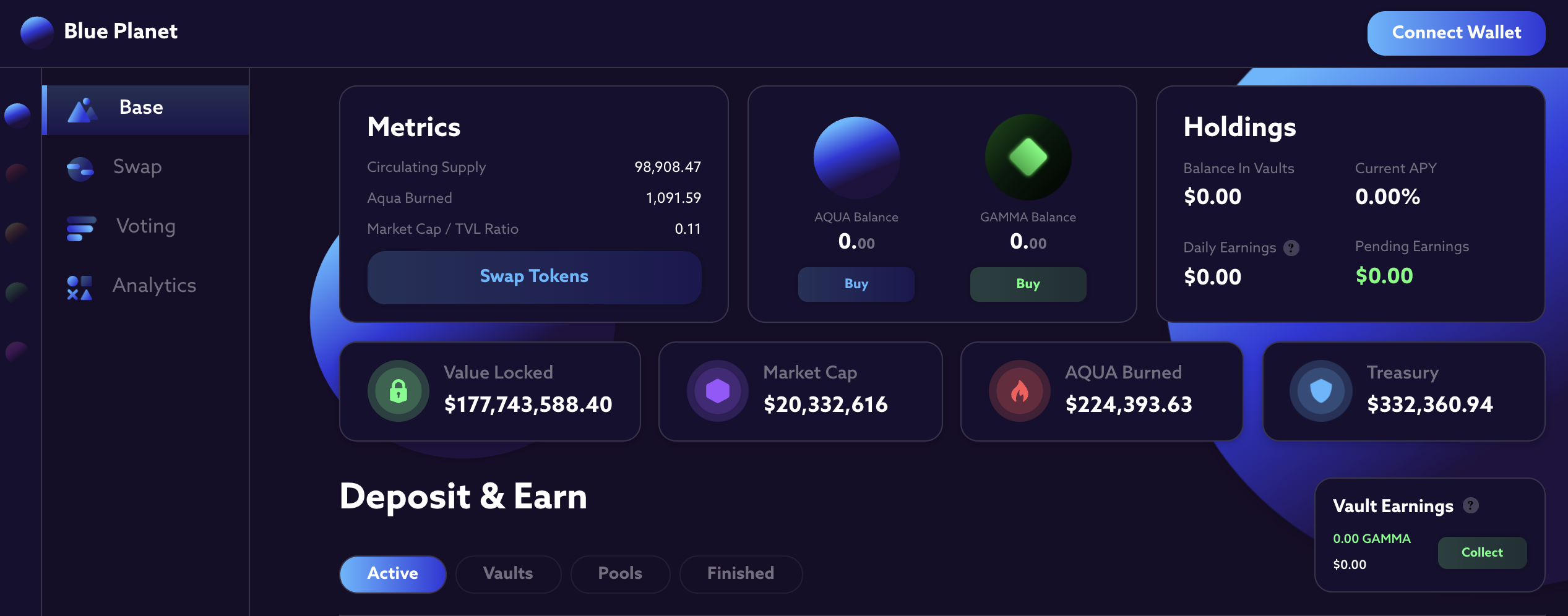

The Blue Planet

The Blue Planet refers to the stablecoin yield service. Here, users can access “the highest stablecoin yields in all of defi,” according to Planet Finance. Stablecoins available here include BNB, USDT, USDC, DAI, and much more.

Stablecoins need to be staked into the vaults to earn yields. There is also a decentralized exchange (DEX) for users to exchange tokens and provide liquidity.

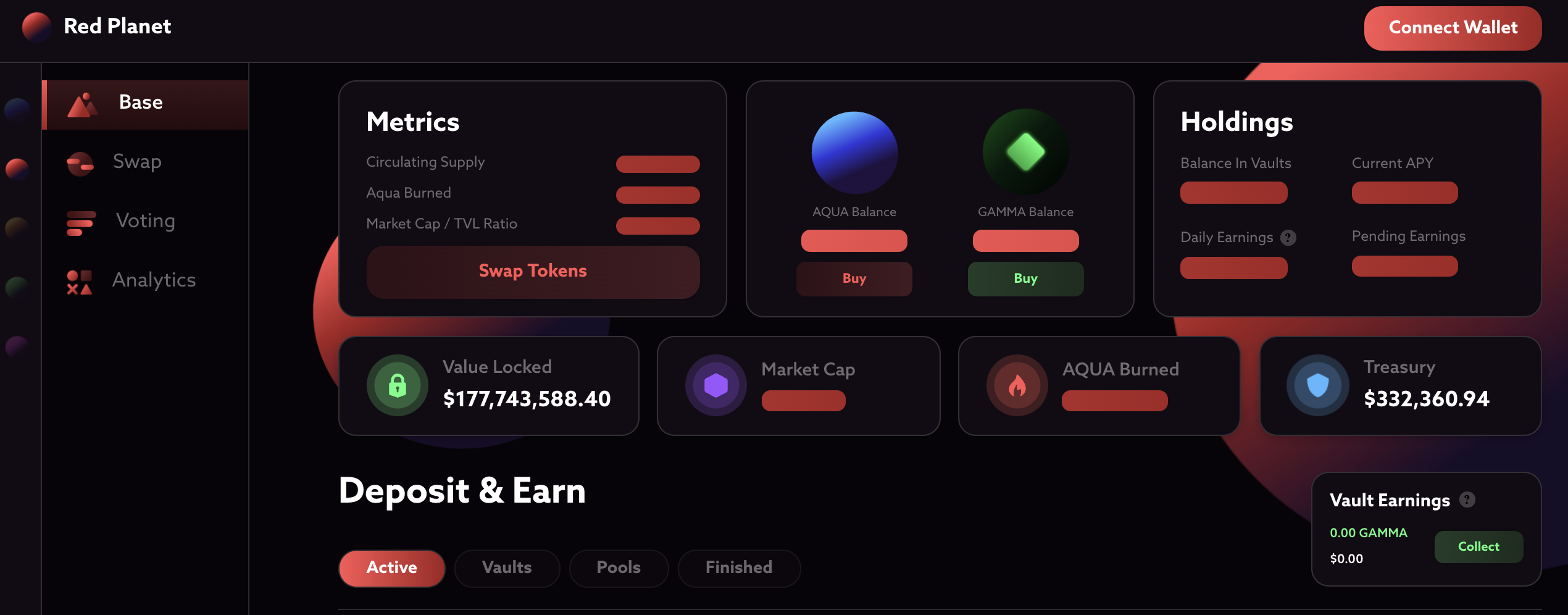

The Red Planet

The Red Planet is where users can access competitive yields on various cryptocurrencies. Here, users have access to vaults with auto-compounding yields. The tokens available here include ETH, CAKE, LINK, and more.

The Red Planet also has a DEX swap function, as well as a vault for $AQUA to stake and earn.

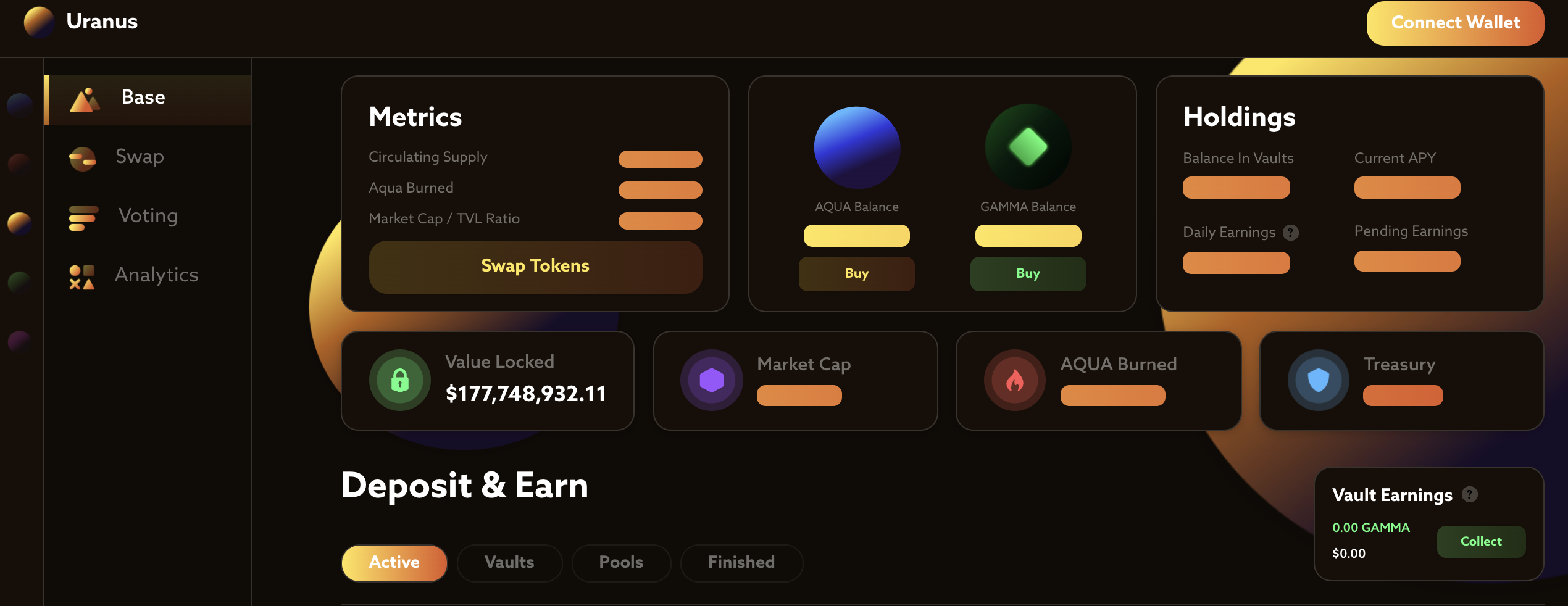

Uranus

Uranus is where users can explore the world of altcoins where yields are automatically compounded. Uranus consists of various pools that have been pulled from PancakeSwap. These include DOGE-BNB, ALPACA-BNB, and more.

Planet Finance explains that CAKE earned from these pools will be used to purchase $AQUA. Users will then be able to claim this back. The vaults each have a multiplier to increase returns to ensure $AQUA has consistent value passing through it.

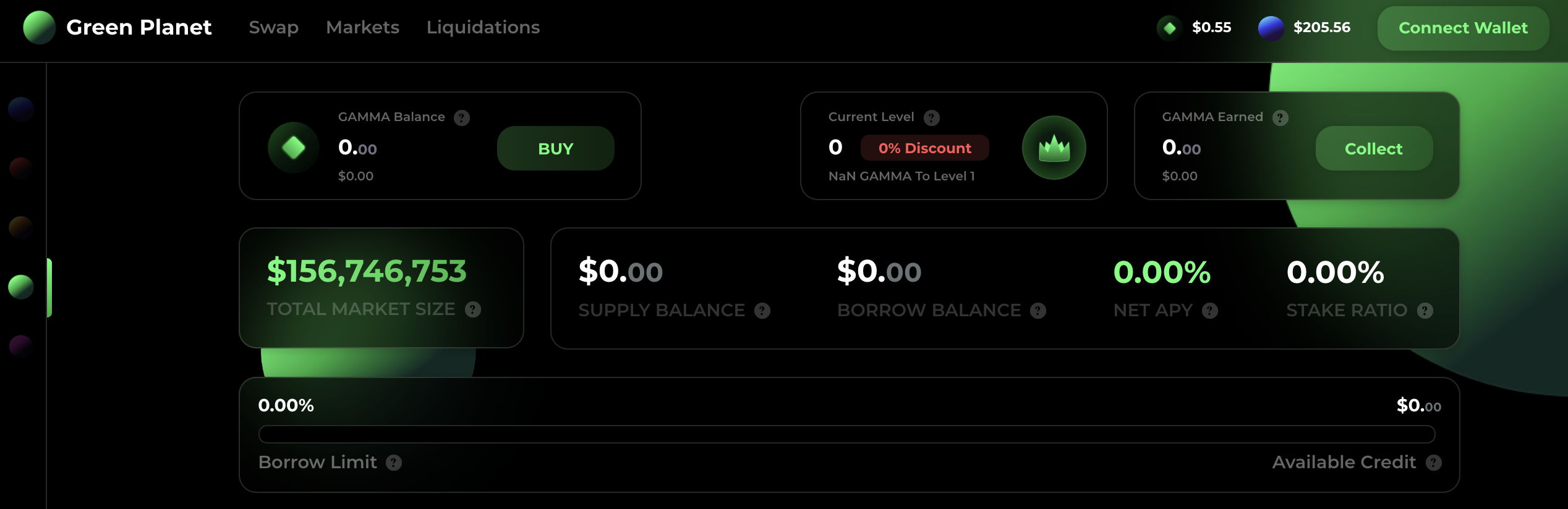

The Green Planet

The Green Planet is a decentralized lending protocol that pays users to lend and borrow. This is powered by $GAMMA – the utility token of the entire protocol.

The Green Planet launched on November 21, 2021. Within the first 48 hours, the total market size was $307,512,580.

Planets under development

The Pink Planet will essentially be Planet Finance’s NFT marketplace. It will allow artists to create and sell their own work that users in the ecosystem can purchase. Be on the watch for Pink Planet, as the team has some innovative tokenomic models that they believe will influence the way NFTs are sold in the future.

Tokenonmics

- Only 100,000 AQUA will be minted

- 500 AQUA was distributed daily for the first 200 days (completed November 18, 2021)

- AQUA will continue to be bought and burned by the protocol forever, with on-chain verifiable public records.

- GAMMA will power the ecosystem forever.

Planet Finance explained that there are zero team tokens and that all tokens are distributed by vault volume with fair distribution from day 0.

“Far too many projects pump and dump on their users to benefit the builders at the expense of both the believers and investors in the platform and DeFi’s reputation as the future of finance,” says Planet Finance.

“Our auto-compounding algorithm will constantly group transaction fees and funds to determine the highest possible returns based on the exact second of critical factors like ever-changing gas fees and yields while saving you time and doing zero work. This means your yields will increase even further as the liquidity pools grow over time.”

Planet Finance is taking DeFi to the moon

With the impressive services currently available, as well as the plans of an NFT marketplace, Planet Finance has gone above and beyond for its community and that of the entire DeFi space.

Stay updated with the protocol here: Website | Twitter | Telegram | Discord |