Blockchain-fueled digital asset trading platform INX Limited, which in 2017 registered in Gibraltar and has US-based subsidiaries, is making a splash in the capital markets.

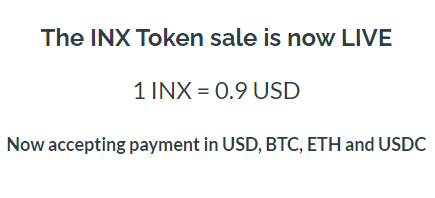

The company’s $117 million regulated token IPO, the first of its kind, is currently unfolding, and it is open to both retail and institutional investors. As of Oct. 27, INX had reportedly raised $10 million of its target. INX set the offering price at $0.90 with a minimum investment of $1,000. While some publicly traded companies have integrated the blockchain in recent years, INX is entering the fray that way as the self-proclaimed maiden SEC-registered token IPO.

‘The Exchange for Entrepreneurs’

Now INX has set trading in its sights, and it has selected an alternative platform with a modern spin. INX has filed an application to list its digital security token, INX Token, on the Canadian Securities Exchange, which is also known as the “exchange for entrepreneurs.” If approved, INX will become a pioneer for digital securities tokens trading on a traditional exchange.

INX Co-Founder and President Shy Datika stated in the announcement,

“Digital securities represent new opportunities in regulated cross-border trading and multi-listings. It is a new era in capital markets where each listed security can be seamlessly traded on multiple exchanges providing much higher access to capital and liquidity for each trading asset.”

The CSE has been a first-mover for digital assets. The exchange’s CEO, Richard Carleton, said,

“The CSE is working hard towards listing solutions that cater to a rapidly changing and increasingly digitized capital markets environment. Digital securities represent a logical evolution in how investment instruments are constructed, issued, and traded on a regulated marketplace.”

Growth by Acquisition

INX plans to direct the proceeds from the public sale toward building a “regulated trading platform for digital assets.” In recent days, the company revealed it would scoop up Chicago-based Openfinance Securities, which is a broker-dealer. The deal includes Openfinance’s alternative trading system comprising digital asset listings, a client base and licenses. As a result of the acquisition, the combined user base of the two companies has doubled to close to 10,000.

Canadian Connection

INX has seemingly been gearing up for its first listing. One of the company’s directors, Nicholas Thadaney, is an alum of TMX Group, where he oversaw equity listing and trading activity across trading platforms including the Toronto Stock Exchange.