Blockchain projects and crypto companies are scrambling to get on the DeFi bandwagon—which has turned into more of a bullet train as of late. The South Korean ICON Network is the latest passenger to hop aboard.

South Korea’s leading blockchain platform ICON is delving into DeFi with its own platform called BalancedDAO. The platform, initially proposed in February, is a decentralized autonomous organization on the ICON Network that creates tokens pegged to real-world assets.

ICON Dives into DeFi

ICON has teamed up with the Band DeFi protocol to provide oracles, and securing data and price feeds for the platform, which was announced earlier this year.

The ICON Network and its technical subsidiary, ICONLOOP, have deep roots in South Korea as the blockchain developer for the government. The platform, founded in 2017, operates on a network of established enterprises and government agencies including banks, telecom companies, and healthcare providers.

ICON has partnered with messaging giants such as LINE and provided blockchain solutions for a number of state-backed projects such as digitizing passports and authenticating personal identity. The project aims to ‘hyperconnect the world’ through its rapidly expanding network using its high-performance blockchain engine, ‘loopchain,’ which connects a number of industries and government departments within South Korea.

Balanced is a DAO, which incentivizes investors to deposit ICX, ICON’s native token, as collateral and borrow tokens pegged to the value of real-world assets. The first token will be the ICON Dollar (ICD), which is pegged to USD. As with other recent DeFi token launches, Balanced has no ICO or pre-sale and will be distributing tokens based on liquidity provision.

The concept was derived as native protocol tokens like ICX are too volatile for payments. By using ICX as collateral instead, the platform can create stable tokens to pay one another within the ecosystem. The initial announcement commented;

DeFi is essential to the success of any decentralized public blockchain protocol, and we’re excited to work on the first piece of ICON’s DeFi ecosystem.

A more recent announcement yesterday updated the developments on ICON’s DeFi ambitions adding that they have chosen the Band Protocol for oracle integration.

Balanced co-founder Scott Smiley praised the move stating it has deemed Band Protocol an excellent oracle solution, that has the capability of accessing numerous, high-quality data feeds that power real-world assets and the underlying collateralization protocol for ICX, adding;

We look forward to launching Balanced with Band Protocol, as well as leveraging their unique value propositions and collaborative team to extend our product offering to the global DeFi community.

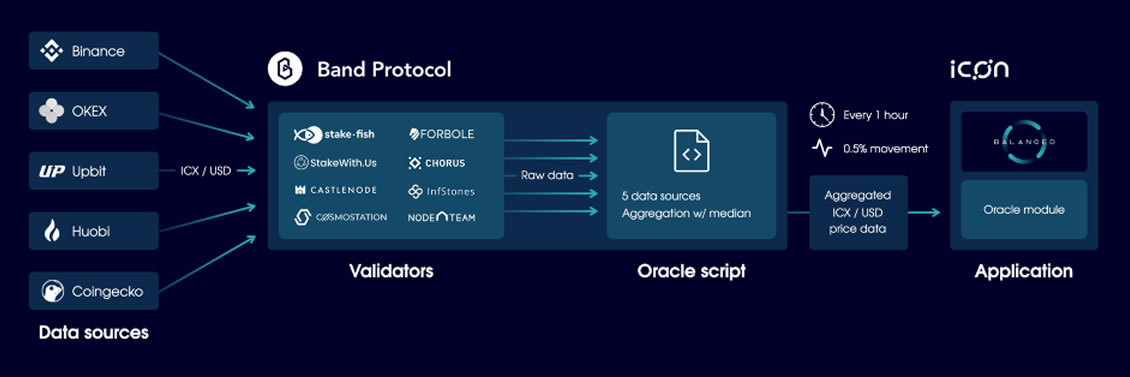

The announcement added that the initial collaboration will center around the ICX/USD price feed in order to maintain correct collateral ratios for the ICD. The price feed will be derived from five unique and trusted data sources: Binance, OKEx, Upbit, Huobi, and CoinGecko.

The overview below shows how the Band Protocol will provide a price feed for Balanced:

The ecosystem will be expanded to support more pegged assets like ICON BTC, ICON Gold, ICON Oil, and ICON ETFs. Specific assets will be nominated via the Balanced governance system and voted upon by token holders. CEO and co-founder of Band Protocol, Soravis Srinawakoon, was excited to be providing oracles for further synthetic assets as the network grows:

More interestingly, Band oracles will be used as Balanced expands their product offering into various synthetic assets such as stocks, gold, oil and more to power the next generation of DeFi on ICON Network.

The Band Protocol has been largely considered as a rival to Chainlink, the current industry leader in price oracles. ICON has worked with both, however, having integrated Chainlink oracles to bring pricing data from traditional markets into decentralized financial products on the network earlier this year.

ICX and BAND Price Update

Under normal circumstances, positive developments, ongoing network expansions, and major governmental partnerships and projects that ICON has been a part of over the past year or so should be bullish for token prices.

Unfortunately for ICX investors, nothing could be further from the truth.

ICON’s native token has been a dead duck in terms of price since the crypto boom in late 2017 when it pumped with its altcoin brethren to an all-time high of over $13. ICX has been trading in a relatively flat line for two years. Today, prices are languishing around the $0.37 level, over 97% down from that ATH.

ICX has actually fallen 14% over the past week and has slid so far down the market cap table that it isn’t even in the top fifty. It seems that nothing can revive this once high-potential token at the moment.

The same cannot be said for BAND though, which has been on fire recently as DeFi FOMO gathers momentum.

Since the beginning of July, when BAND tokens were priced just over a dollar, it has surged a whopping 310% to reach an all-time high of $4.56 last week. A minor pulled back followed but the token is still up more than 20% on the day.

DeFi Market Update

For the first time this month, DeFi markets have not posted a new all-time high in terms of total value locked. A slight correction has seen the TVL value fall back to $3.61 billion, though this is likely due to the slight pullback in Ethereum prices over the past 24 hours.

The top-three DeFi platforms have all increased their TVL with Compound leading the way, adding 6% over the past day. Maker’s market dominance has inched slowly higher as its TVL pushes past the billion-dollar level and demand for Dai increases.

Today’s top movers are two tokenized Bitcoin protocols wBTC and RenVM, with the stablecoin aggregator mStable adding a respectable 13% in TVL. It appears that collateral is getting liquidated on Aave, Curve Finance, and Yearn Finance as their TVL values have all dropped by double-digits.