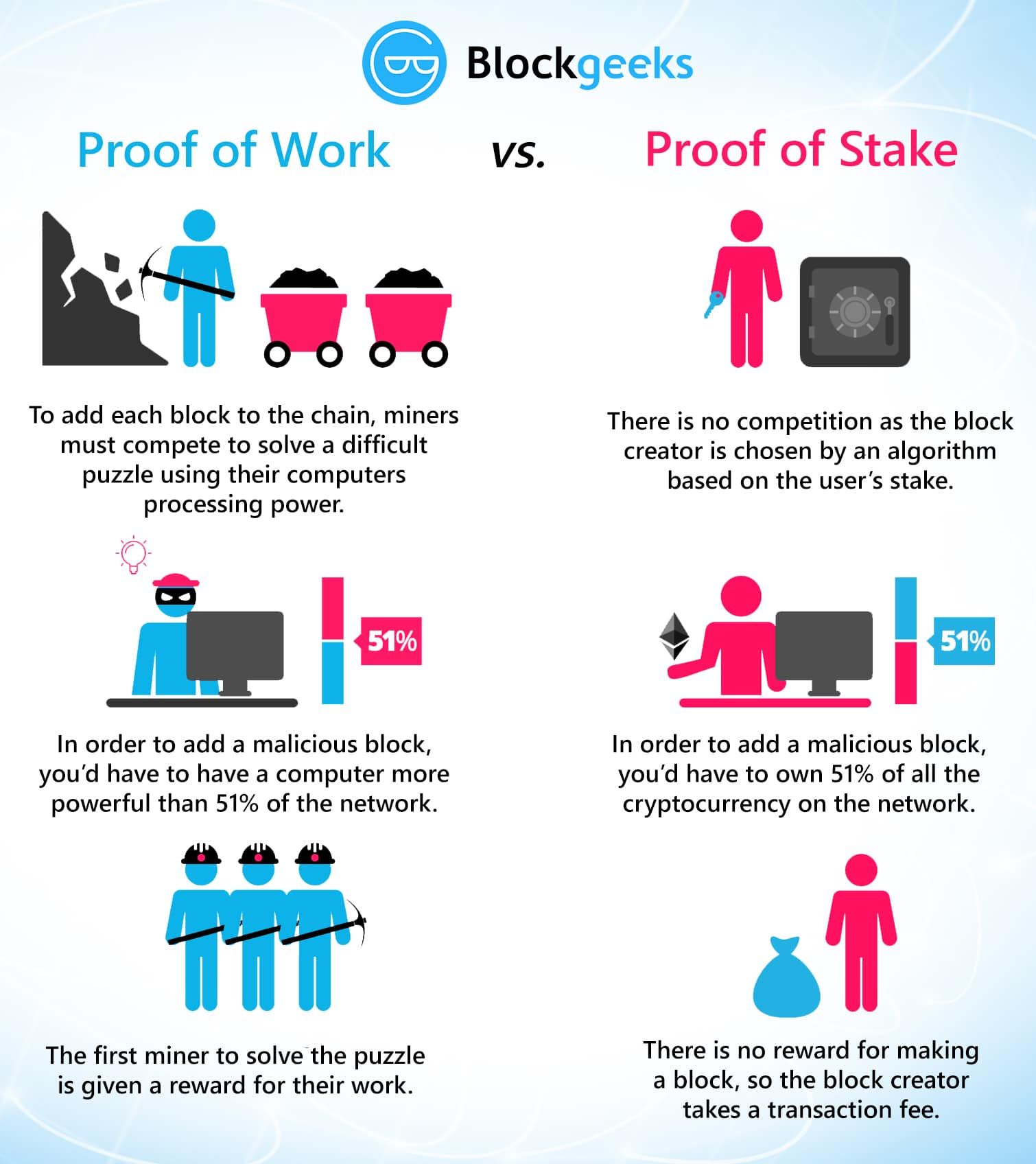

When Bitcoin was first envisioned over a decade ago, it was designed in such a way that a decentralized consensus mechanism was needed to verify or validate transactions without relying on a centralized authority such as a bank. Proof-of-Work was the mechanism of choice as it could be done using some mathematical calculations on a basic computer.

Move along ten years, and the proof-of-work method is slowly becoming obsolete. This is largely due to the centralization of crypto mining hardware and mining pools, advances in computers, and increasing power consumption as the process gets more difficult over time.

The next evolution in blockchain consensus is Proof-of-Stake which replaces computers doing work with assets being staked to ensure consensus and network security. It is essentially a mechanism that forces all network validators to have ‘skin-in-the-game’, or a ‘stake’ in order to validate transactions.

According to Binance Research, Sunny King and Scott Nadal were likely the first to introduce the concept of Proof of Stake and staking, back in 2012.

This Guide Contains:

How Does Staking Work?

To understand staking there must be a little knowledge of proof-of-work (PoW) and mining which is the most popular consensus mechanism for the majority of blockchains at the moment.

To arrive at consensus and validate the next block on the chain, work must be completed by computer hardware. The reward is some of the currency that is being worked on.

Proof-of-Stake (PoS) replaces this power-hungry, number crunching process with rewards issued for assets staked on the network. This incentivizes coin holders to stake them, as it is in their interest that the network is healthy and transactions can be validated quickly and efficiently.

PoS also helps security by creating a ‘wall of value’ against would-be attackers, with the size and strength of this wall coming from the amount and value of tokens that make it up.

Usually, stakers that pledge larger quantities of coins have a higher chance of being chosen as the next block validator, and receiving the associated rewards. This could cause concerns of centralization as the whales profit more than the average person and have a greater control of the network.

The process of staking can be as simple as just transferring the crypto coin of choice from the exchange to its associated wallet and letting the assets start earning. Many exchanges now offer staking services but caution must be taken as some of them take a hefty cut of the rewards for the privilege.

What is Delegated Proof of Stake?

There is another consensus algorithm called Delegated Proof of Stake (DPoS) which has been considered as a more democratic method of staking. The mechanism works using a voting system whereby stakeholders outsource their work to third parties or vote for a few delegates that will secure the network on their behalf. Block producers are elected using this method, so they will be motivated to be honest and efficient else they get may get voted out.

Advantages and Disadvantages of Staking

There are several benefits to staking but as with anything, there are also disadvantages. The list below shows that the pros outnumber the cons when staking is considered.

Staking Advantages

- Uses way less electricity and physical resources than mining

- Security is improved as stakeholders have a vested interest in network health

- Blockchains using PoS are much faster and can scale quicker

- Easier source of passive income without spending a lot on mining equipment

- Double earning potential if token prices increase

- Staking pools can help coin holders merge resources to increase chances of validating blocks and receiving rewards

- No need to have any trading experience or knowledge

Staking Disadvantages

- Possible centralization as whales holding a lot of tokens may have more influence over the network

- Crypto prices are still volatile so staked assets could depreciate

- Staking with some coins may require them to be locked up for set periods

Best Coins to Stake in 2020

The number of crypto assets with staking protocols is rapidly rising. Just a few years ago nearly every blockchain was operating on PoW, but with increasing environmental pressure, scaling limitations, and security concerns, PoS is becoming more popular.

Mining is highly competitive, centralized by geography and mining pools, and requires a lot of investment and the sourcing of cheap power. Staking has none of these drawbacks, which is why it is becoming the standard for crypto consensus models.

Ethereum is currently in the process of switching from PoW (ETH 1.0) to PoS (ETH 2.0) through its Serenity upgrade. At the time of writing the first phase of this upgrade is on testnet only, but staking opportunities should be available for Ethereum by the end of 2020.

Ethereum is the world’s largest and most popular smart contract and decentralized application platform so it is likely to be one of the top assets for staking when it is finally launched.

Other popular altcoins for staking include EOS, Tezos, Tron, Cosmos, NEO, VeChain, Ark, Lisk, Loom, Decred, Stratis, ICON, Qtum, PivX plus a few other low cap coins. This article will explore staking the most popular ones below.

Ethereum Staking and Rewards

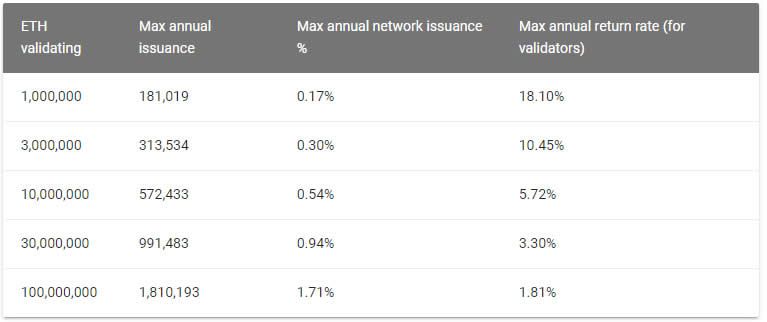

As mentioned above, Ethereum staking is not available yet but is expected to be sometime in late 2020. The Casper consensus upgrade will herald in one of the most highly anticipated developments in the crypto industry.

The transition will completely alter the economics of Ethereum as anyone with 32 ETH will be able to stake them to become a validator. The balance must be maintained for continued network health;

“If the incentive to stake is too low, the network will not get the minimum amount of validators needed to keep many shards going. If the incentive is too high, the network is overpaying for security and inflating at a rate that is detrimental to the economics of the network as a whole.”

Staking rewards are the incentive for people to pledge their Ethereum to the network, it is a payment in ETH for every successful block validated. Estimates of possible payouts are as follows:

These are theoretical numbers, however, and there are a number of factors that can affect issuance.

It is likely that major exchanges will offer Ethereum staking services, for a cut of course. Staking pools are also likely to become available for those that do not have the full 32 ETH in order to participate on their own.

Altcoin Staking

Since Ethereum staking is still a few months away, there are opportunities to earn rewards staking other altcoins. Some are rapidly growing in popularity which has been reflected in steady price increases. Below is a brief introduction to the most popular staking coins at the moment.

Tezos (XTZ) Staking/Baking

Tezos is probably the most popular altcoin for staking at the time of writing. It has also been one of the best-performing ones in terms of token price for the past year or so. Tezos uses a process called ‘baking’ which, according to the official website, is the act of signing and publishing blocks to the Tezos blockchain. Bakers ensure that all transactions in a block are correct, that the order of transactions is agreed upon, and that no double-spending has occurred.

The process appears quite complex and has a lot of terminologies to overcome, a comprehensive guide has been written here. To make things easier, the major exchanges such as Coinbase and Binance, offer XTZ staking services for those without the technical knowhow – but as usual they will take a slice of the rewards. Delegating a ‘baker’ is also an option to earn from staked Tezos tokens and there are a number of ‘baking pools’ available.

EOS staking

EOS has come under fire recently and has largely fallen out of favor due to centralization issues arising from its structure and delegated PoS system. Staking EOS is possible for individuals as it uses computing resources and bandwidth. Staking tokens increases the two recourses called CPU and NET limits that are required to perform actions on the EOS blockchain. As with other tokens, exchanges are offering staking services using their resources instead of the holders.

Tron Staking

Tron also uses DPoS but instead of ‘bakers’ it has something called Super Representatives (SR) which are obligated to produce blocks and record transactions, and in return receive corresponding votes and block production rewards. The process is similar whereby tokens are loaded and locked into the relevant wallet and a validator is selected in return for rewards for the stake.

NEO Staking

NEO has often been referred to as the ‘Chinese Ethereum’. It shares similarities with its big brother being a smart contract and dApp platform that also offers staking opportunities. The NEO network runs on a sister token called GAS which can be earnt just by holding NEO tokens. One they are deposited in a staking capable wallet, the earnings are automatically received in GAS. The difference is that it does not use computer resources, and there is no minimum amount to enable earnings.

VeChain Staking

VET is another token that can be staked for rewards, and the system is similar to that with others that need to simply be deposited in their corresponding wallet. VeChain (VET) works as a payment currency for business activities and VeThor (VTHO) is used as a fee for smart contract execution and network activity, similar to gas. VTHO is the staking reward for holding VET.

Staking on Exchanges

Not everyone is comfortable with crypto transactions, wallet management, and keeping their own private keys secure, so exchanges can offer these services. The major exchanges listed below offer staking services for various crypto assets, however, some only support their partnered projects, while others have a wider range.

All will take a cut of the staking reward for providing the service. This is where shopping around can help as the staking fees range from zero to as much as 25% on Coinbase. Binance currently offers the greatest range with 23 crypto assets available for staking with annual yields ranging from 1% to 16%.

There are also a number of newly launched staking providers that provide similar services to the major exchanges. Stake Capital, Stake.Fish, Staked, and Stakinglab are among them.

Staking Pools

Another option for earning passive income from staking crypto is to join a staking pool. These allow token holders to join together to combine computing resources in order to increase their chances of receiving the block rewards.

The concept is similar to a traditional mining pool which also operates on a shared resource principle. A pool manager will be in charge of the specific pool, and stakers will be able to join to collaborate with others seeking the same goal, a greater chance of winning the reward.

Staking pools often yield smaller and more frequent payouts as the reward must be divided by among the many participants of the pool. Additionally, most pools will charge a fee or cut of the overall staking reward just as the exchanges do but they also remove the technical hurdles that some may not be comfortable with.

Staking Wallets

Most PoS crypto tokens have their own dedicated staking wallet, however, there are a number of options that support multiple coins.

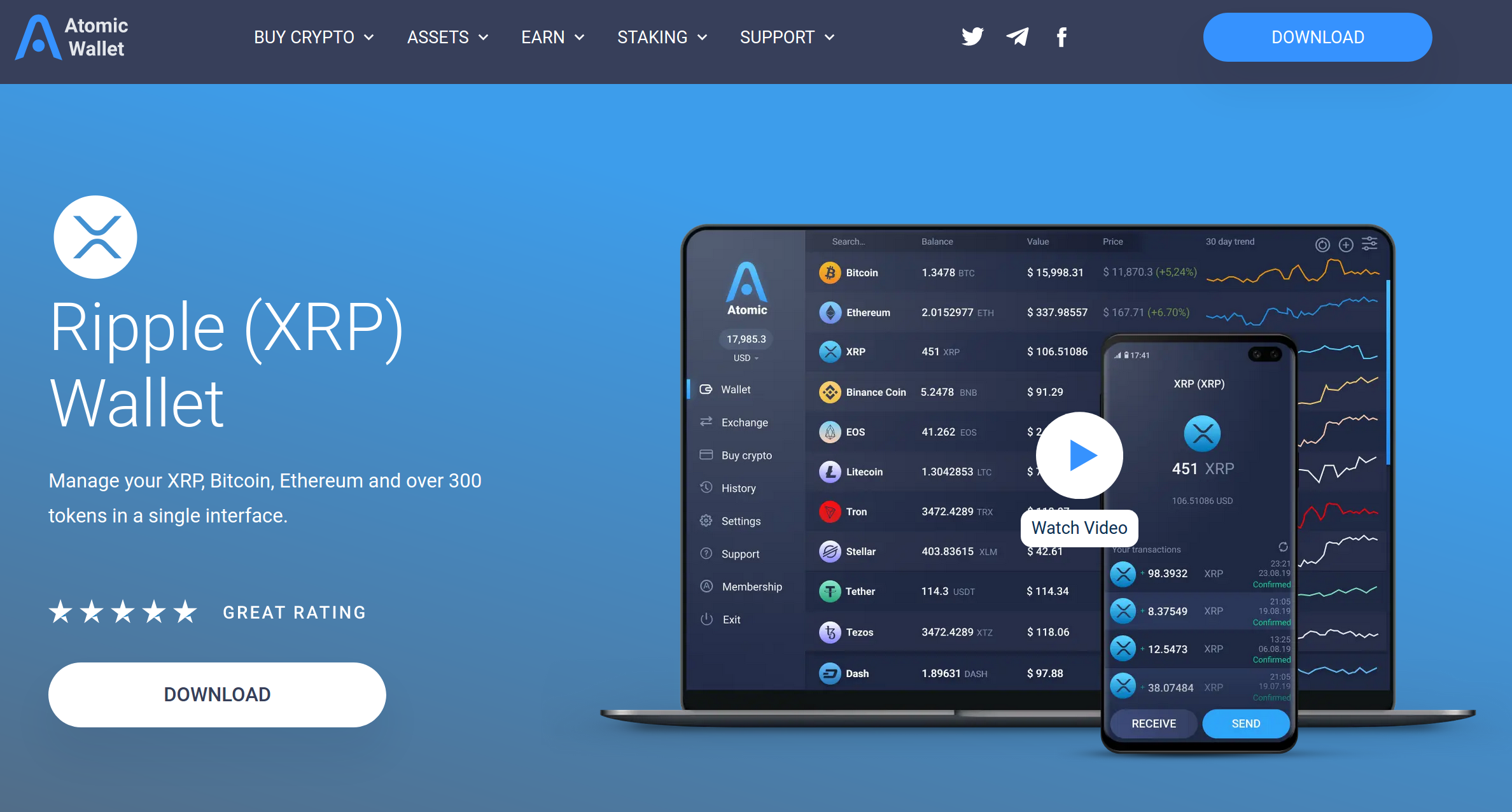

- Atomic Wallet supports most of the top stakable tokens including Tezos, Tron, NEO, Cosmos, VeChain, and Cardano. It claims to offer zero-fee decentralized staking.

- Alternatively there is Trust Wallet which is a similar platform also offering a range of PoS tokens including Tezos, Tron, Cosmos, VeChain, and Algorand.

Staking Resources

There are a number of others but these two appear to be the most popular at the time of writing.

Hardware wallets such as Ledger also provide a staking platform but not all PoS coins support cold or offline staking. Most coin wallets also provide a staking calculator that allows users to enter the number of assets they wish to stake and a time frame for an estimate of returns.

As staking grows in popularity, the resources to find the best coins to stake, rates and providers will also become available. At the time of writing, there were only a few but they include:

- Stakingrewards – data provider for staking and crypto-growth tools

- Attestant.io – in-depth guide to Ethereum staking ecosystem