Cryptocurrencies are on their way to global penetration, as their prominence continues to grow, and people find more use for them. Bitcoin, Ether, and other prominent cryptocurrencies have seen their use cases expand significantly. People buy them for varying reasons. Some buy them to use for payments, hedge against the failures of traditional financial systems, and as investment vehicles.

There are various ways of purchasing cryptocurrencies. You could buy them through an individual or an exchange. However, regardless of how you procure your digital assets, you’ll always find the need to use a cryptocurrency exchange.

How Cryptocurrency Exchanges Work

Cryptocurrency exchanges are platforms where investors can buy, sell, and trade one digital asset for another or for fiat currency. Their major function is to facilitate the transfer of digital assets, but they do so much.

The function of cryptocurrency exchanges is rather extensive, and the most popular exchanges have been able to diversify their operations, providing services such as custody and leverage trading. Some exchanges also tap up traditional companies to open up spending options for cryptocurrencies. It’s not unusual to find exchanges creating Debit Cards that are pre-filled with crypto and can be used to withdraw fiat at an Automated Teller Machine (ATM).

Types of Cryptocurrency Exchanges

Cryptocurrency exchanges can be divided into several forms. The classification is often based on the functions they provide and the type of users they are suited for. Generally, we have three types. We have centralized crypto exchanges, decentralized crypto exchanges (DEX), and hybrids (combines centralized and decentralized functions.)

Centralized Exchanges

Centralized exchanges are the most popular form of exchanges. They are used by users to buy and sell cryptocurrencies. They come in different forms and sizes, and the most popular exchanges- Coinbase, Binance, BitMEX, Huobi, and OKEx- are examples of centralized platforms.

One aspect that distinguishes centralized from other types of exchanges is in their ownership structure. Centralized exchanges are often owned by a single individual or a group, who controls the platform and charges you a fee for using it.

Most centralized exchanges are often incentivized to keep innovating by producing new products and services to keep their customers in a fierce market. This is why so many of them often launch multiple products frequently. Some exchanges offer margin trading, custodial services, staking, and others provide specialized services in a bid to keep customers.

Decentralized Exchanges

Also known as DEX, a decentralized cryptocurrency exchange isn’t run or managed by a single group or individual like a centralized exchange. It’s a platform that decentralizes the core functions of an exchange. These include asset trading/exchange, order matching, capital deposits, and order books. Decentralization means there’s no central figure or server. The network’s nodes are distributed, thereby cutting out the middleman, allowing users to execute trades using smart contracts. This reduces the costs associated with centralized exchanges and speeds up the processes.

The following are some of the most popular decentralized exchanges:

Bancor

Bancor is an on-chain liquidity protocol that automates swaps on Ethereum and other blockchains. The exchange uses Bancor’s smart token to facilitate trades with quick throughput and low fees. It uses the principle of a reserve currency, in this case, BNT, to automate exchanges between different assets.

Bancor also features a liquidity mining program and the ability to provide automated liquidity to any asset. It also allows the provision of single-sided liquidity, impermanent loss protection, and BNT rewards.

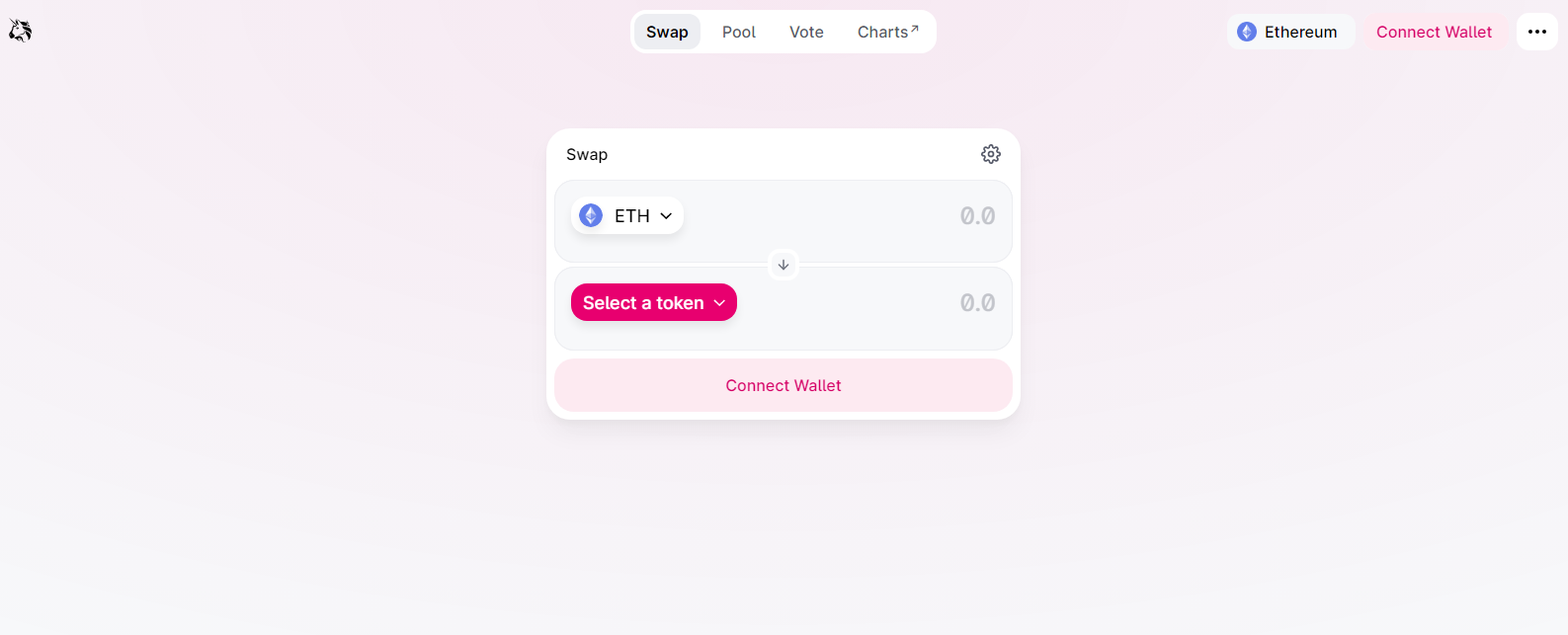

Uniswap

Uniswap is one of the market’s most popular Automated Market Makers. Like others of its kind, users can become liquidity providers, for which they are rewarded. What distinguishes it from other DEXs is its constant product market maker model, which is its pricing mechanism.

The latest version, Uniswap V3, also introduced concentrated liquidity and multiple fee tiers. This leads to better capital efficiency and risk management.

Stackswap

Stackswap is a relatively new entrant to the DEX market and is the first complete DEX and launchpad on the Bitcoin network, powered by the Stacks blockchain. It is due for a full release in November 2021

The Stacks blockchain acts as a layer 2 chain on top of Bitcoin and thus enables smart contract functionality. Besides token swaps and liquidity mining, it also enables trading pools through liquidity provision, a launchpad, and token compensation programs.

There is a peculiar type of token called Proof of Transfer-Lite(PoXL), which resembles Stacks Blockchain’s Proof of Transfer(PoX) consensus mechanism on its operation. PoXL tokens possess inherent potential to provide holders not only yield in STX, but also in BTC.

Up until now, deploying PoXL tokens required significant development resources due to its complexity, but Stackswap’s token launchpad enables non-programmers to quickly issue PoXL tokens on the blockchain and provide a mining interface for the users without a single line of coding. This streamlines the onboarding process of new ecosystem members. It is already cooperating with the popular MiamiCoin.

Types of Decentralized Exchanges

There are mainly two types of decentralized exchanges. We have the currency-centric and currency-neutral DEX. The difference lies in the blockchain the DEX is built on and the number of currencies you can trade on them. Currency-centric DEX, as the name implies, are platforms built on a particular blockchain, say Ethereum blockchain. For exchanges like this, the platform is limited to allowing users to trade the asset it’s built on, such as ERC20 assets. Currency-neutral allows for more freedom. The system allows users to connect different digital assets for secure order handling and matching in a decentralized manner.

The Pros and Cons of Decentralized Exchanges

Pros of Using a DEX

When compared to centralized exchanges, decentralized platforms are secure. The lack of a centralized storage location means they don’t have a single point of failure. Even the best centralized exchange can be compromised, and millions of customer funds stolen from the company’s storage. This is impossible on a decentralized exchange. On DEX platforms, the users have control over their private keys. They don’t store it on the exchange. Another benefit of a decentralized exchange is censorship-resistance. DEX platforms are not subject to government laws or censorship. They are not owned or controlled by a single individual, and as such, the government can’t exert any form or control or monitor their transactions. This is a big deal as many countries have taken the ban route to limit or stifle the growth of the cryptocurrency sector in their region.

Cons of Using a DEX

The major drawback of DEX companies is limited functionality. DEXs lack quite a number of useful features. Features like margin trading, stop loss, and much more are missing from the DEX arsenal, all of which could hinder your performance as a trader. Some exchanges are working on adding new features, but it might take a while before these features roll out. Decentralized exchanges are also quite challenging to use, but their user interface is getting better by the day. Another drawback is fiat conversions. Due to their makeup and opposition to any form of centralization, you can’t make fiat conversions, as this opens the platform to everything it’s not. Cryptocurrency investors can only trade using crypto deposits.

Why DEX Adoption is Slow

One reason why DEX adoption has been slowed is due to the lack of functionality on the decentralized platforms. Many investors use centralized exchanges for reasons that go beyond just buying and selling cryptocurrencies. DEX platforms are just too limited for now to attract a wide base of investors. Low liquidity is also a concern for investors with deep pockets. Then, you also have the government’s need to put a leash on the crypto sector. In the U.S., several government agencies have given reasons why they need to monitor transactions on the blockchain. The FBI says it wants to monitor illicit transactions and protect investors from dubious operators. The IRS wants to monitor every cryptocurrency transaction for tax purposes. Whatever the reason, DEX platforms are created to hide user detail and transactions from central authorities, which means the government is blind to their activities. If they end up replacing central exchanges, billions of dollars could fly under the radar. This could become concerning for a lot of investors who run legitimate businesses.