Bitcoin: Freedom, backed by real-world utility, and a solid tokenomics will enable the fulfillment of Bitcoin’s original mission, says Jin Gonzalez, Chief Architect of Oz Finance.

When the world’s first cryptocurrency was born in 2008 most people hadn’t heard of it, and those that had didn’t understand it or made it a punchline.

Things have changed drastically since then. And not just the price of Bitcoin, which rose from a fraction of a penny to close to $70,000 in November 2021, and back to around $20,000 over the last several months. This exciting period witnessed new industries grow, expand, and trigger other sub-industries.

Bitcoin has been the driving force behind all of it, establishing itself as the benchmark store of value and means of exchange with over 81 million wallets in existence. Still, it’s becoming increasingly clear the world’s first cryptocurrency has yet to fulfill its promise of gaining global adoption as a functioning legal currency, or as an inflation hedge.

In addition to not achieving widespread adoption as a functioning currency, Bitcoin, or any cryptocurrency for that matter, hasn’t provided the benefits and freedoms that they originally intended.

Falling short

In the early days of Bitcoin, staunch advocates believed that the coin would offer complete discretion, privacy, security, and most importantly financial independence. Despite there still being many hardcore Bitcoin believers, many began to realize that Bitcoin’s public nature doesn’t ensure all this because it’s quite easy to track transactions on the Bitcoin blockchain.

People are still taxed on profit realized on Bitcoin. The blockchain can be used to identify individuals and monitor transactions, and the ledger can be used as evidence against an individual who is compelled to submit their KYC. Then Bitcoin, and by extension all crypto, expanded its vision of freeing the masses from traditional finance to other use cases. That is, as a hyper-secure and efficient transfer of value, a store of value, an inflation hedge.

Bitcoin and the stock market

That didn’t quite work out. Instead, it finds itself mimicking the stock market and, in particular tech stocks, albeit with higher degrees of volatility. This doesn’t bode well for those who sought to diversify their portfolios in defense against exploding inflation. The current on-going market downturn has exposed Bitcoin as not being truly independent of the mainstream financial world. This is due to its fluctuations being in lockstep with international markets.

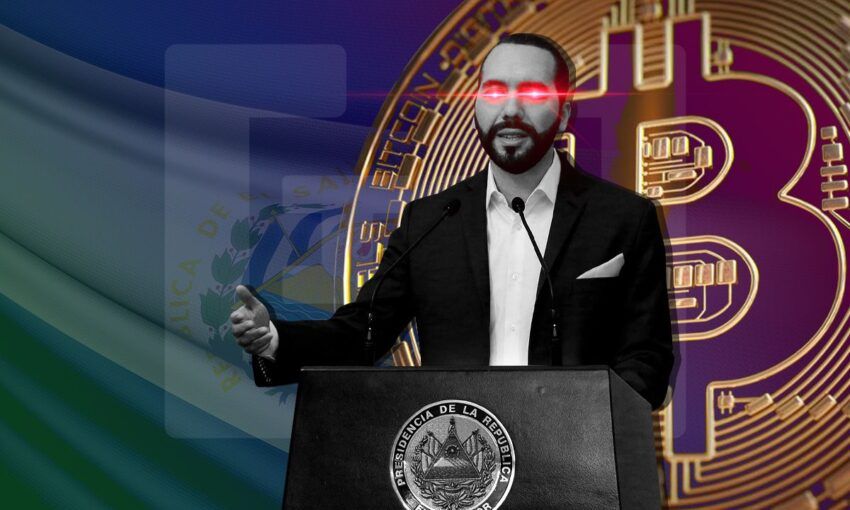

Bitcoin actually got a second chance to prove itself as a functioning currency when El Salvador became the first country to pass legislation making Bitcoin a legal tender. But even after that, many businesses in the country El Salvador were unable to accept Bitcoin for a myriad of reasons. And this is on top of a laundry list of other problems plaguing the Bitcoin launch in the small Central American nation of six million.

El Salvador’s half-baked launch of Bitcoin so far hasn’t produced the results that many citizens and Bitcoin evangelists were hoping for, when the historical announcement was made last summer. Given the idea that Bitcoin hasn’t provided the basic freedoms it sought to enable, do cryptocurrencies have a real future going forward?

If not Bitcoin, then what?

Crypto has staying power, and this bear cycle has enabled an industry-wide shift that has refocused the emphasis on building. The previous bull cycle placed too much emphasis on token launches and hype. But not enough on building actual products and services to support the token’s value. This is being corrected as we speak, but the industry is still suffering from a lack of real-world utility.

Crypto and blockchain projects need to go a different route than they have been. Instead of rushing to pump a new hyped-up token into the oversaturated market, the focus should be on how to provide the benefits that Bitcoin and blockchain initially intended. This means providing financial freedom through privacy protection, balanced regulatory cover, and a fair-tax regime. Now neither Bitcoin or any other major token or cryptocurrency truly provide this.

Web3

Crypto and the greater Web3 environment is still full of potential. But to ensure that this bear cycle produces results, the main priority needs to focus on the freedoms of privacy, regulatory, and tax protections. These freedoms, backed by real-world utility, and a solid tokenomics will enable the fulfillment of Bitcoin’s original mission.

An ideal token should think big but act local at the onset, meaning gaining recognition and regulation from a national or regional government before expanding or doing an IDO (initial DEX offering). Legal reviews and smart-contract audits can be leveraged to provide transparency and build credibility. This lays the groundwork for legal onboarding into a structured environment with proper regulatory cover.

Crypto projects must wake up and realize Bitcoin has fallen short. If the industry is going to spur a financial revolution and usher us into a Web3 future, it needs to be done by a coin that provides something more than just speculative hype. A crypto industry that prioritizes developing and innovating new products and services, while offering these freedoms, will indirectly benefit Bitcoin as it would benefit the entire crypto ecosystem. Going forward it is imperative that we support projects and use cases that translate in the real world or else this bear market will never go into hibernation.

About the author:

Jin Gonzalez has established six startups over the years, including two successful exits. Prior to founding Oz, a digital assets project with the aim of connecting a network of special economic zones across the globe, he was responsible for pioneering the adoption and embracing of blockchain technology at the Union Bank of the Philippines, as their Director of BD, Fintech, and Blockchain. Gonzalez is also the Executive Director of the Distributed Ledger Association of the Philippines.

Got something to say about Bitcoin or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.