Ethereum (ETH) is making its sixth attempt at breaking out from a resistance line. If successful, the next resistance would be between $1,650 and $1,725.

ETH has been falling underneath a descending resistance line since reaching a high of $2,031 on Aug 14. So far, it has made six attempts at breaking out (red icons).

Since resistances get weaker each time they are touched, an eventual breakout from the line seems to be the most likely scenario.

RSI supports the breakout

The readings from the six-hour RSI support the possibility of a breakout. The main reason for this is the bullish divergence that has developed over the two most recent lows. Furthermore, the RSI is in the process of moving above 50. Additionally, the wave count also supports the possibility of a breakout.

If a breakout transpires, the closest resistance area would be between $1,650 and $1,725.

ETH merge

The Ethereum Merge is expected to happen on Sept 15. It will completely transition the Ethereum blockchain from proof-of-work to proof-of-stake. Ahead of the event, options traders are betting heavily on a price increase.

@DeribitExchange noted that there is a huge amount of calls relative to puts, and open interest has nearly quadrupled over the past year.

A large portion of puts expire on Sept 2 and 30, while the cast majority of calls are set to expire after the merge, more specifically on Sept 30 and Dec 30. Therefore, options traders are expecting a post-Merge increase in the price of ETH.

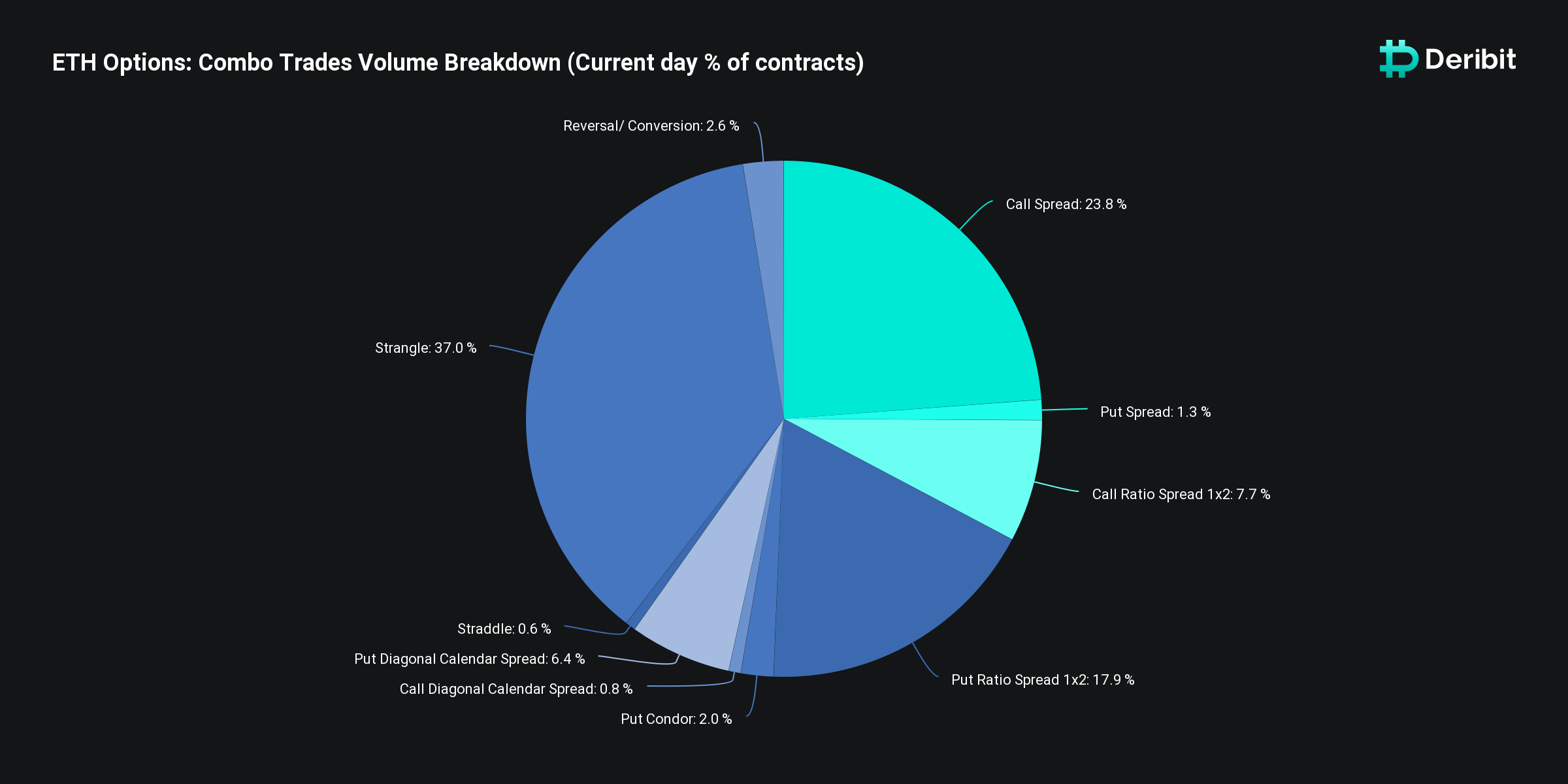

Another interesting realized from looking at various hedging strategies used by options traders. Today, the highest number of open contracts are led by Strangles (37%) and Call Spreads (23.8%).

The Strangle is a strategy in which both a call and a put are bought, since the trader is expecting volatility. Therefore, while the premium paid on both options is lost, the trader makes a profit if the price moves considerably in one or the other direction, triggering one of the strike prices (the set price in which a derivative can be bought or sold). So, this is essentially a bet on volatility.

Conversely, a Call Spread is a bet on the price increasing, which however has a built-in hedge. In it, the trader purchases a call with a strike price above market price, and sells a call with a strike price even higher above the market price. In it, the trader only loses the difference between the premiums. However, in case the price appreciates, the trader makes a maximum of the difference between the two strike prices.

So, using these charts, it is possible to summarize the sentiment of traders as cautiously bullish but definitely expecting volatility throughout the merge.

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here