Crypto markets are showing some signs of recovery but it could be a dead cat bounce as the macroeconomic environment is still painfully bearish.

Cryptocurrency markets are back over the $1 trillion level again, but celebrations are premature as they’re still down almost 70% from November 2021’s peak.

The minor bounce has seen Bitcoin prices gain 4% on the day to reach $22,127 at the time of press. This is a little over its realized price of $21,963 according to Willy Woo’s Bitcoin Price Model’s chart.

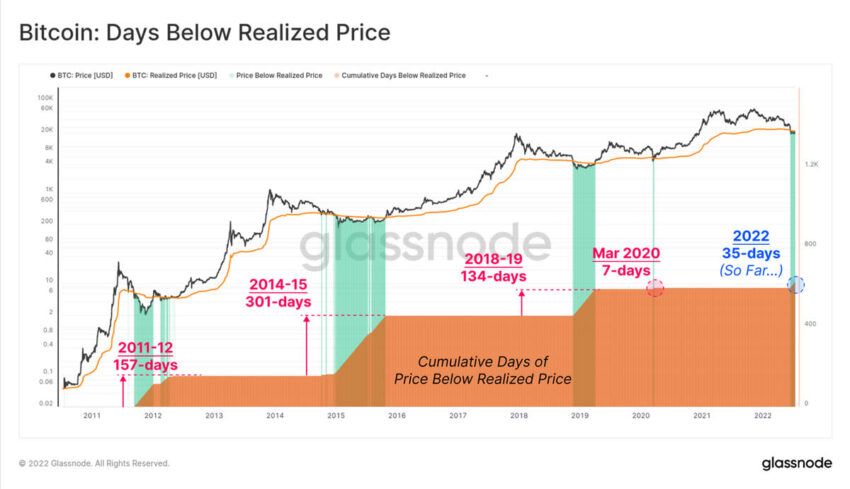

On July 18, on-chain analytics provider Glassnode reported that BTC had traded below its realized price for over a month. There were several signals that a capitulation had already occurred:

“As a result, numerous signals indicate that genuine bottom formation could be underway.”

Market bottom formation

The massive deleveraging event caused BTC prices to drop to a current cycle low of $17,760 on June 19. But it has remained range bound since then and is still technically within that channel and has yet to break out despite the 10.7% gain over the past week.

Bitcoin realized price is the value of all coins in circulation at the price they last moved, or an approximation of what the entire market paid for their coins.

Glassnode compared the current 35 days below the realized price (not including today’s move to just above it) with previous bear markets. The average time spent below realized price is 197 days meaning that there could be a lot further to go at the bottom.

Glassnode concluded that on-chain metrics and trends resemble previous bear market lows. However, the one thing lacking was the duration of time spent at the bottom. This suggests that the current market momentum could just be a dead cat bounce with further losses expected before any long-term recovery can be measured.

Macroeconomic headwinds

It stated that “against a backdrop of extremely challenging macroeconomic, and geopolitical turmoil,” high conviction hodlers are causing BTC to reach peak investor saturation. This could result in the formation of a “genuine bottom” which is likely to last for several months yet.

Further negative economic news out of the U.S. this month, including another Fed rate hike and the declaration of a recession after two financial quarters of negative GDP, could dampen this short-term market momentum very quickly.

Several prominent economists have also questioned Bitcoin’s inflation hedge properties recently as it has failed to live up to them.