Digital asset management firm Grayscale Investments has revealed that its assets under management have exceeded $9 billion. It also suggests that there is much more growth to be found going forward.

Digital asset management firm Grayscale Investments offered an update on its holdings, which now exceeds $9 billion. The firm has added to its already considerable holdings in 2020, buying nearly 20,000 BTC in the week after the halving alone.

Barry Silbert, founder and CEO of parent company Digital Currency Group, also noted the marked increase in interest in crypto. Silbert tweeted shortly after the update that Grayscale had added $500 million to assets managed in one day.

This ballooning investment is a sign of a migration toward the cryptocurrency market from incumbent investors and large companies. Several companies, including Jack Dorsey’s Square, have invested their reserves into bitcoin.

Microstrategy invested over $400 million in bitcoin. The company’s CEO, Michael Saylor, has repeatedly spoken of bitcoin’s safety as a hedge after once being skeptical of the asset class.

Grayscale’s Performance Increases All Round

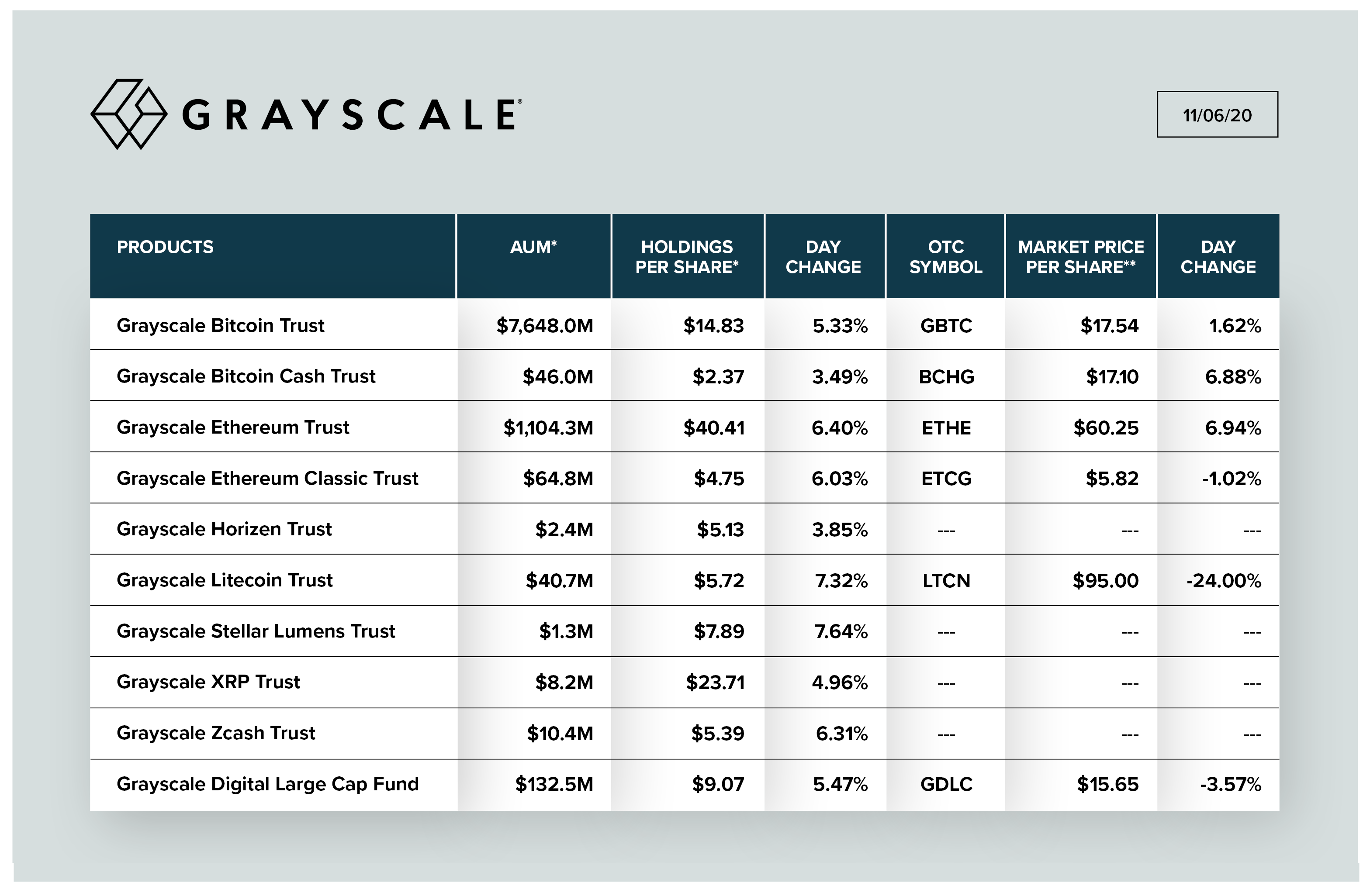

Grayscale has added to its holdings since the start of the year. The firm’s bitcoin trust is now just over $7.6 billion, by far its biggest investment vehicle. The trust increased by $1.6 billion in the first half of 2020 alone.

This is followed by the Grayscale Ethereum Trust, which has $1.1 billion assets under management — some way behind the bitcoin trust. Still, it is one of the strongest performing options for Grayscale this year, with over $58 million added this year. Ethereum has experienced YTD growth of 237%.

With Ethereum 2.0 just around the corner, investors are hopeful that there is more profit potential going forward. Other trusts fall far behind bitcoin and Ethereum but have still experienced tremendous growth. Following these is the Ethereum Classic and Bitcoin Cash Trusts, with $64.8 and $46 million AUM, respectively.

Big Names Entering the Market Just as Bitcoin Rallies

Big Names Entering the Market Just as Bitcoin Rallies

The aforementioned companies have been entering the market just as bitcoin is experiencing one of its strongest rallies yet. Investors are hopeful that 2020 will see bitcoin reach or surpass its ATH of $19,783. Bitcoin’s rallies have typically occurred in quick fashion at the end of the year. This could make December a month when this could very well happen. Many analysts have predicted that this is a real possibility, including those at Bloomberg.

Big Names Entering the Market Just as Bitcoin Rallies

Big Names Entering the Market Just as Bitcoin Rallies