The increasing adoption of decentralized exchanges (DEX) is becoming more apparent with DEX tokens outstripping their centralized counterparts based on price performance year-to-date (YTD).

While centralized crypto bourses still control the lions share of trading activity, DEX platforms appear to be gaining in momentum. Trading volume on decentralized crypto trading services continues to rise amid protocol upgrades that are helping to make decentralized exchanges easier to use.

DEX Tokens up 241% YTD

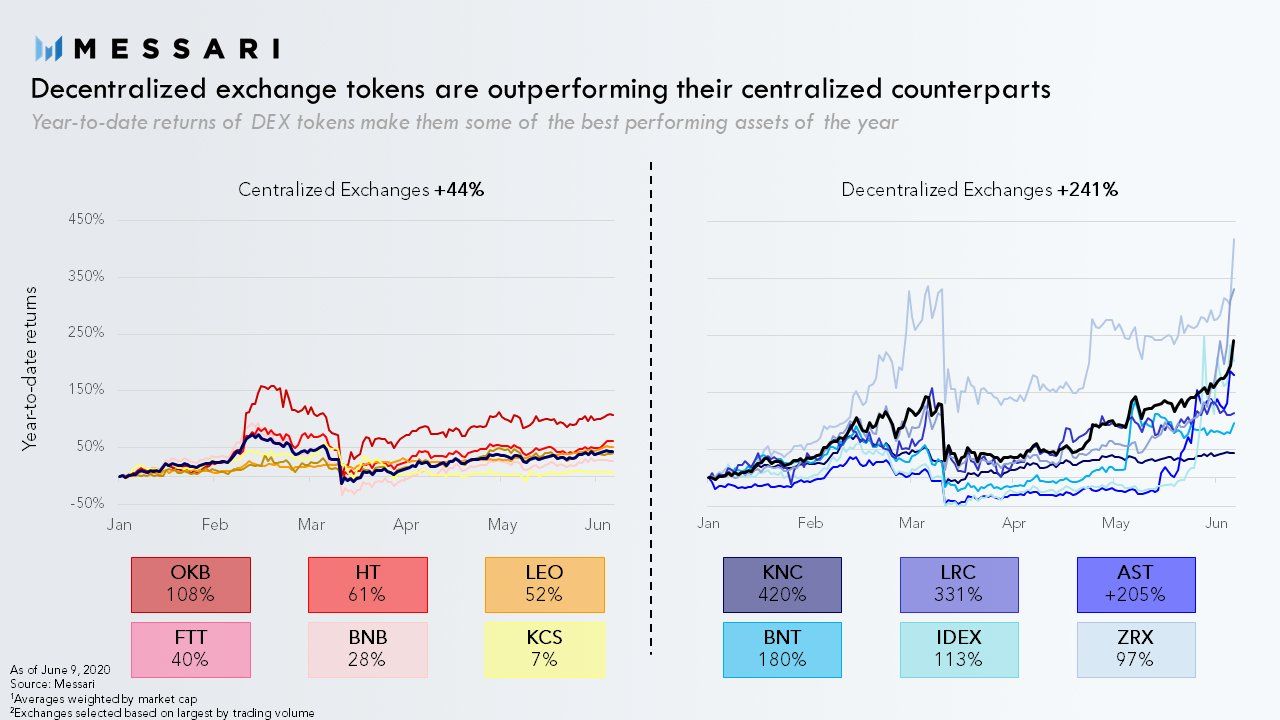

According to cryptocurrency analytics provider Messari, DEX tokens have performed five times better than centralized exchange (CEX) tokens so far in 2020. Indeed, Messari’s figures show the average DEX token performance at 241% against CEX ‘coins’ at 44%.

Kyber Network (KNC) is the best performing crypto exchange native token, gaining over 550% since the start of the year. As of press time, KNC is up by about 28% over the last 24-hour trading period. KNC has continued to trend upwards since the start of June, almost doubling in value.

Other top performers in the DEX token category include Loopring (LRC) at 385% YTD with AirSwap (AST) and IDEX (IDEX), each posting 270% gains within the same period. Other high performers include Bancor (BNT) at 226% and 0x (ZRX) at 116%, respectively.

For CEX tokens, OKB – the native coin of the OKEx crypto trading platform – is the best performing asset so far in 2020. OKB has more than doubled from $2.61 a coin on January 1 to over $5.34 as of press time.

Huobi token (HT) has also almost doubled its 2020 starting price and is close to recovering from the Black Thursday decline, which affected the entire crypto market. Others like Bitfinex’s LEO and FTX token (FTT) are also up by more than 50% YTD.

Geofencing and Protocol Improvements Likely Driving DEX Adoption

The massive gains in DEX token prices likely points to the increasing adoption of decentralized exchanges, driven by several factors. One such force may be greater scrutiny from regulators on cryptocurrency trading.

As previously reported by BeInCrypto, strict U.S. crypto regulations appear to be pushing American traders towards DEX platforms. Back in 2019, some centralized exchanges began geofencing specific altcoin tokens from users Stateside due to unclear securities laws.

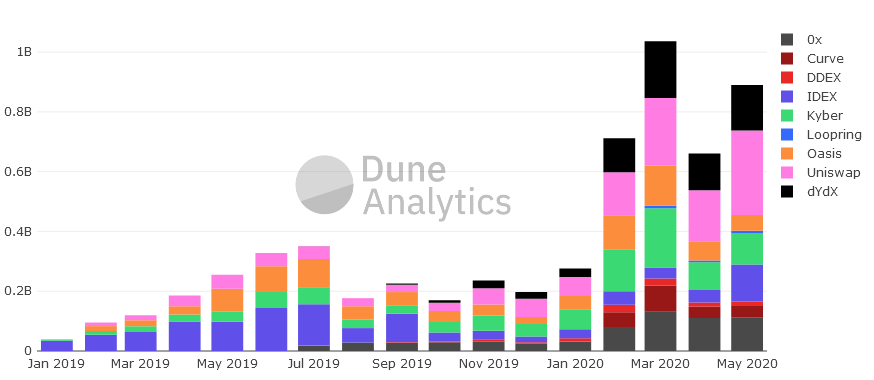

Data from Dune Analytics shows a massive increase in Ethereum-based DEX trading volume since February 2020. Indeed, the total DEX trading volume between January and May 2020 crossed $3B. This figure is already higher than the $2.4B recorded for the whole of 2019. In other words, DEX trading is well on its way to setting a new annual volume record.

Since DEX platforms theoretically exist as non-single protocol implementations, website geo-blocking is not a clear and present danger for users. The absence of fiat deposits and withdrawals also puts them outside of the scope of regulators whose anti-money laundering (AML) laws usually involve the use of fiat currencies.

While the theoretical advantages of DEX over CEX services are known, issues concerning ease of use and liquidity have historically prevented a more broad-based adoption of decentralized exchanges. Robust solutions to the above issues may push DEX platforms into controlling a greater share of the crypto trading arena.