Crypto newbie? Interested in investing while the bear market has brought on some bargains? Then here are some good starting points.

Despite the crypto winter, interest in cryptocurrency investing is still growing. The market cap of the crypto market grew exponentially from 2020 to 2022.

Crypto Newbies: Need to Know

What are the fundamental points that every investor must carry out before and during investments in the crypto market?

Max Krupyshev is the CEO of CoinsPaid. “It’s first and foremost important to understand that there are lots of different kinds of crypto investors. You should start off by getting a feel for the industry to decide what kind of approach you want to take to crypto investing. Whether you’ll end up opting for monthly dollar-cost-averaging or high-frequency day trades, the most important thing is to figure out your preferred strategy as time goes on.”

Nicolas Tang is the Director of internal communications at Phemex. “Investing requires a lot of work and research. It is never as simple as identifying a project whose value has been steadily rising and buying its token or stock. There are countless examples of seemingly unstoppable projects that have collapsed in the course of days. Many of these relied on transient hype and trends to manufacture a facade of success. Fundamental analysis can help determine whether the people and ideas behind a company have enough merit or potential to truly succeed.”

For the investment to be carried out successfully, the investor must carry out the following steps.

Analyze the type of cryptocurrency

The consumer should carefully analyze the type of cryptocurrency that they are going to acquire. A stable currency such as Tether or a value currency such as Bitcoin will not be the same.

Be sure you understand if the cryptocurrency has a backing in a real asset, if its value is determined by the supply and demand of the market, and you are able to analyze the levels of volatility that the cryptocurrency has.

Crypto newbies: Always study the whitepaper of the project

After the user has been able to determine the type of cryptocurrency in which he is interested, he should study the Whitepaper of the project in detail.

The user can find different key points of the project in the whitepaper such as:

1. Description of the project behind the cryptocurrency

2. Technology behind the cryptocurrency

3. Main characteristics of the project

4. Cryptocurrency market risk

In this example, we will be able to see some of the main characteristics and the description of Tether, through the study of its Whitepaper.

Crypto newbies should always investigate who is behind the project

There are thousands of cryptocurrencies within the crypto market. To avoid being part of a scam or a pyramid scheme, the investor should investigate the project behind the cryptocurrency, and who the founders are.

Rodrigo Torres is the Director of Valora Analitik. “Literature and experience indicate that in the world of investments, the best way to start is to know the market in which you want to deposit surplus liquidity. Another recommendation is not to invest the resources you may need tomorrow for issues such as food, housing or basic expenses. It is recommended to start with low amount investments and with resources that will not be needed in the short term”.

Crypto newbies should analyze the price and market cap

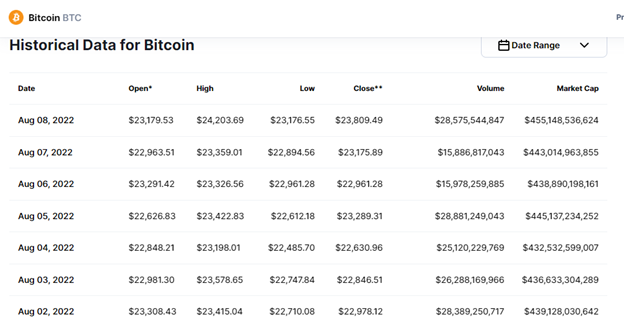

You must analyze different variables of the cryptocurrency, using a trusted page such as CoinmarketCap.

Cryptocurrency price

By analyzing the price of the cryptocurrency, we can see if it is in a moment of low or high, and make a purchase decision based on this.

Market Cap

According to the description of Coinmarketcap, we can understand that the market cap is, “The total market value of a cryptocurrency’s circulating supply. It is analogous to the free-float capitalization in the stock market.”

In other words the Market Cap = Current Price x Circulating Supply.

In the above image the user will be able to see the total supply of Bitcoin in the present and that it has a decrease of 3.76 percent. The analysis of said data will help us to understand how much dominance of the market the cryptocurrency has.

Crypto newbies should read the recent history of price variations

Carry out a brief analysis of the behavior of your crypto of choice. How volatile is it? What are the market trends?

In this graph, the investor will be able to analyze the prices of Bitcoin during different periods of time. Also they can analyze open market price, higher, lower price and closing price on different dates.

The investor can study how the price of the cryptocurrency was evolving throughout a day at different times. In this case, the value of Bitcoin decreased over the hours.

Crypto Newbies: The takeaway

The cryptocurrency market is one of the most volatile markets in the world. Investing is an activity that takes time and dedication. It is essential that the new investor dedicates a fair amount of time getting to know the lay of the land before starting. Only invest what you are willing to lose. And, have fun!

Got something to say about being a crypto newbie or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.