Yesterday’s cryptocurrency market saw a loss of nearly $30 billion, causing Bitcoin (BTC) to sink to a 2018 low point and forcing many altcoins to new all-time lows. Is this what Bitcoin capitulation looks like?

So far, November has once again shown off its famous volatility — and while, historically, this has normally signaled an upward price movement, this time around, Bitcoin (BTC) and the crypto space plunged to double-digit percentage losses in the span of just 12 hours.

Losses across the board totaled a whopping $30 billion dollars lopped off of the total cryptocurrency market cap value — its biggest loss since the beginning of September.

It is important to keep in mind that a $30 billion dollar cut off the market cap is only a drop in the bucket compared to the first quarter of 2018 when the cap value was hemorrhaging hundreds of billions of dollars in the span of only a few days.

The Bitcoin price dipped briefly under $5,300 on the Coinbase exchange — which is $500 dollars less than Bitcoin’s previous low for the current year — and has settled to the $5,400 level at the time of writing.

Crying Uncle?

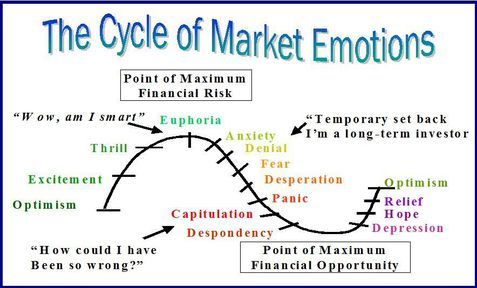

In traditional markets, a normal market cycle contains a phase commonly referred to as ‘capitulation,’ where inexperienced investors will finally surrender their positions and sell at a huge loss to avoid any further unrealized losses.

This move is often joked about as the ‘buy high, sell low’ strategy and highlights just how irrational investors can act during prolonged periods of downward movement — as well as how much of a role one’s emotions can play when there is little-to-no plan of action in place on their entry and exit for any given position.

It is no secret that investors will have certain emotional responses, which will often present as a reflection of the state of the market they are invested in. This is often times shown as a sinusoidal graph that can help us to better understand how easily the market can influence the spectrum of positive and negative emotions and, in turn, how those emotions can cloud judgment and be detrimental to a portfolio.

A 2012 article from Forbes presented a graph, reproduced below, displaying these common emotional responses to an upward and downward moving price.

As shown on the graph, capitulation occurs just before the market reaches a bottom, when investors begin to really doubt not only their positions but the actual asset, stock, or cryptocurrency itself. This often corresponds to price sinking to a level which they feel is past the point of no return.

Smart investors count on these pivotal stages to shake out the amateurs and create points of maximum financial opportunity by accumulating on long positions at the lowest possible prices.

Tips ‘n’ Tricks

Separating emotions from our investments can be one of the most challenging hurdles to overcome for an investor, but can really help to mitigate losses during times of uncertainty or a market downturn.

The number one thing to keep in mind anytime you look to take a position is to make a plan on an entrance price and exit price — before jumping in blind.

There is absolutely nothing wrong with cutting your losses on a position if it starts to run away from you.

By having stop-losses set to buy or sell when the price reaches a certain mark, each individual investor is able to set parameters for acceptable losses and gains and helps to take the emotional guesswork out of the equation during the bad times. (And the good.)

Seasoned investors and Wall Street will look forward to these capitulation periods knowing that they will be able to accumulate on their long-term positions with projects of companies that they believe in for the long haul. Some say smart investors think in terms of years or decades, not months or quarters.

This is a great time to practice dollar-cost averaging — a strategy that involves choosing a set dollar amount and time frame to invest in a particular project. This plan of action lowers your risk of overextending in any particular position and ultimately allows the investor to purchase more ‘shares’ when the prices are low and less ‘shares’ when the price rises.

Always keep in mind that if a project’s fundamentals become compromised, each investor should make their own personal decision to abandon ship.

One way to reduce one’s aversion to this type of risk is to always do thorough research on anything that you invest in. Research the team and their experience. Research the business model and financial structure. Additionally, in most cases, research the technology or the product that is driving the project.

Doing this can help you to learn how to spot risks and disadvantages — and better decide how much risk you are willing to expose yourself (and your portfolio) to.

Finally, use this experience as a valuable lesson to tweak your strategy for the next time the bulls come to town and trigger the next bull run.

Do you think that we’ve reached the point of capitulation? Do you have any strategies on thriving in a bear market that you’re willing to share? Let us know in the comments below!