The Chicago Mercantile Exchange (CME) has overtaken OKEx to become the largest market for Bitcoin futures in the world.

Traditionally, CME’s BTC futures figures are seen as the closest thing that exists to a metric that gauges institutional involvement in Bitcoin.

The new record was revealed on Nov. 27 in a Twitter post by the crypto research and analysis firm Arcane Research, citing figures from Skew Analytics.

Significance Of CME’s Bitcoin Bulls

On Nov. 18, BeInCrypto reported that CME’s open interest on Bitcoin futures exceeded $1 billion for the first time, signifying a possible strong inflow of institutional investment. This figure means that CME has usurped OKEx as the largest consumer Bitcoin futures platform.

Open interest measures the total number of outstanding futures contracts that are yet to be settled, which gives an accurate picture of an asset’s market popularity. The latest data shows that the CME’s Bitcoin futures have now achieved a total value of $1.16 billion, exceeding OKEx which has $1.07 billion of open interest futures.

Arcane believes that this is proof of long-awaited institutional entry into large scale, long-term Bitcoin investments. CME’s November 2020 futures contract BTCX20 expired on Nov. 27 with settlement due today, Nov. 30.

The expiration coincided with a significant selloff that saw Bitcoin dump as far as $16,600 before rallying back to close above $18,000 on Nov. 29.

A Measure of Investment Interest

On Sept. 27, BeInCrypto reported that on-chain analyst Willy Woo predicted a decoupling of Bitcoin from the stock market, driven by what he referred to as ‘internal adoption.’ This he said, is not a measure of traders moving funds around to hedge positions, but rather signals that these are long-term holders.

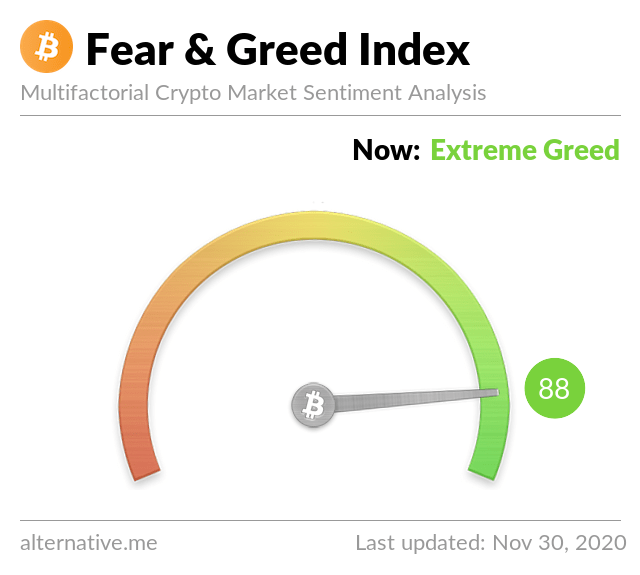

The latest numbers show that following the brief thanksgiving selloff, BTC continues to attract immense investment attention with the latest fear and greed ranking putting it at 88. This is just seven points behind its all time high.