A new coin report shows that Celsius Network has over $2 billion in liabilities in various coins. Bitcoin (BTC) and Ethereum (ETH) make up the majority of the liabilities.

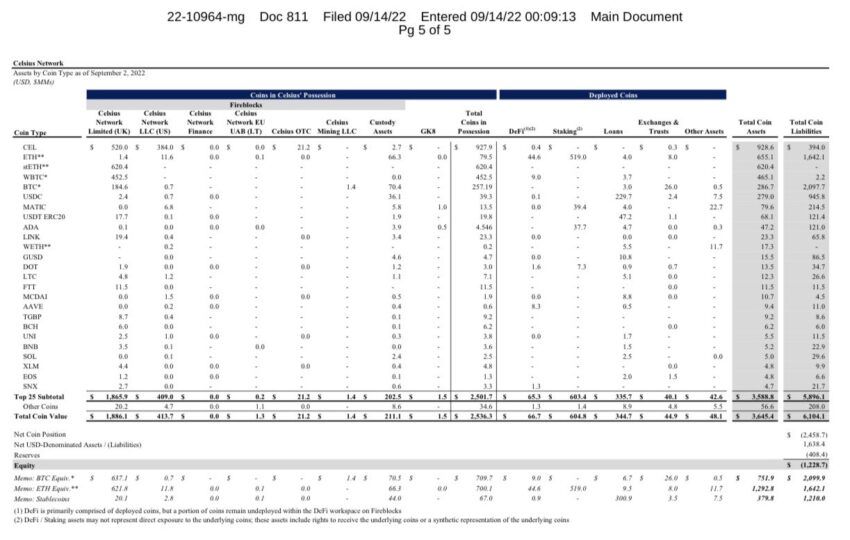

A new coin report shows that Celsius Network (CEL) has over $2 billion in liabilities in various cryptocurrencies. Net crypto liabilities stand at $6.1 billion, while assets under management are at $3.6 billion. There has been no significant change from the last coin report that was released last month.

The vast majority of these liabilities are in BTC, ETH, and CEL. The former two account for approximately $3.7 billion in liabilities. However, in total, there are 25 total cryptocurrencies that make up the portfolio. In terms of dollar value, there is a $1.8 billion deficit for BTC, $987 million for ETH, and $666 million for USD Coin.

The data was shared on Twitter by bankruptcy lawyer David Adler. The report does not paint a good picture of Celsius, which has been struggling to get through its bankruptcy proceedings. Several developments have occurred in the past few weeks, which add to the drama of the case.

Judge approves motion for an independent Celsius examiner

The United States Trustee’s Office had asked for an independent examiner in the Celsius case. The filing for the examiner said that there were questions surrounding the transparency of Celsius’ finances and operations. A Vermont state regulator also supported the use of an independent examiner.

On Wednesday, U.S. Bankruptcy Judge Martin Glenn approved the involvement of an independent examiner, and that the examination would focus on the company’s crypto holdings, the procedures for paying various taxes, changes in account offerings, and more.

CEL token briefly spikes

With all these developments taking place, it is a surprise that the CEL token rallied briefly by over 90% on Thursday. However, much of those gains dropped, and the token is now over 6.5% down over the past 24 hours.

The New York Times reported on Tuesday that Celsius CEO Alex Mashinsky is planning a comeback for the firm. The focus would be on custody, though it’s hard to imagine how Celsius could manage a revival after the reputational hits it has taken in recent months.