Along with the rest of the equity markets, the Bitcoin price has been hit hard as COVID-19 has wreaked havoc on markets around the globe. However, when looking at the Bitcoin performance relative to other assets, some bullish patterns are starting to take place.

One such event is ‘decoupling.’ The Bitcoin price has begun to move in a different direction than the S&P 500, which has gone straight down over the past month. This suggests that Bitcoin could enter a prolonged accumulation phase, but has already reached a bottom.

While there will most likely be less capital for investing in high-risk assets such as Bitcoin, institutional investments are still possible, especially with the possibility of traditional markets closing. This would most likely aid in its recovery.

Furthermore, the third halving occurred in the end of May. Traditionally, the BTC price has gradually increased prior to halving and has accelerated its rate of increase afterward. This event takes on increased importance due to the ongoing massive fiscal stimulus by central banks throughout the globe. This should have a bullish effect on assets with a limited supply such as Bitcoin since fiat currencies are being devalued even more.

It remains to be seen if Bitcoin will ever be the cryptocurrency that everyone ends up using. But, its likelihood of sticking around for the long-term is higher this year than it ever has been.

In light of this development, BeInCrypto is going to make an attempt to predict the Bitcoin price at the end of the year, on December 31, 2020, 2021, and 2025.

Short-Term Prediction

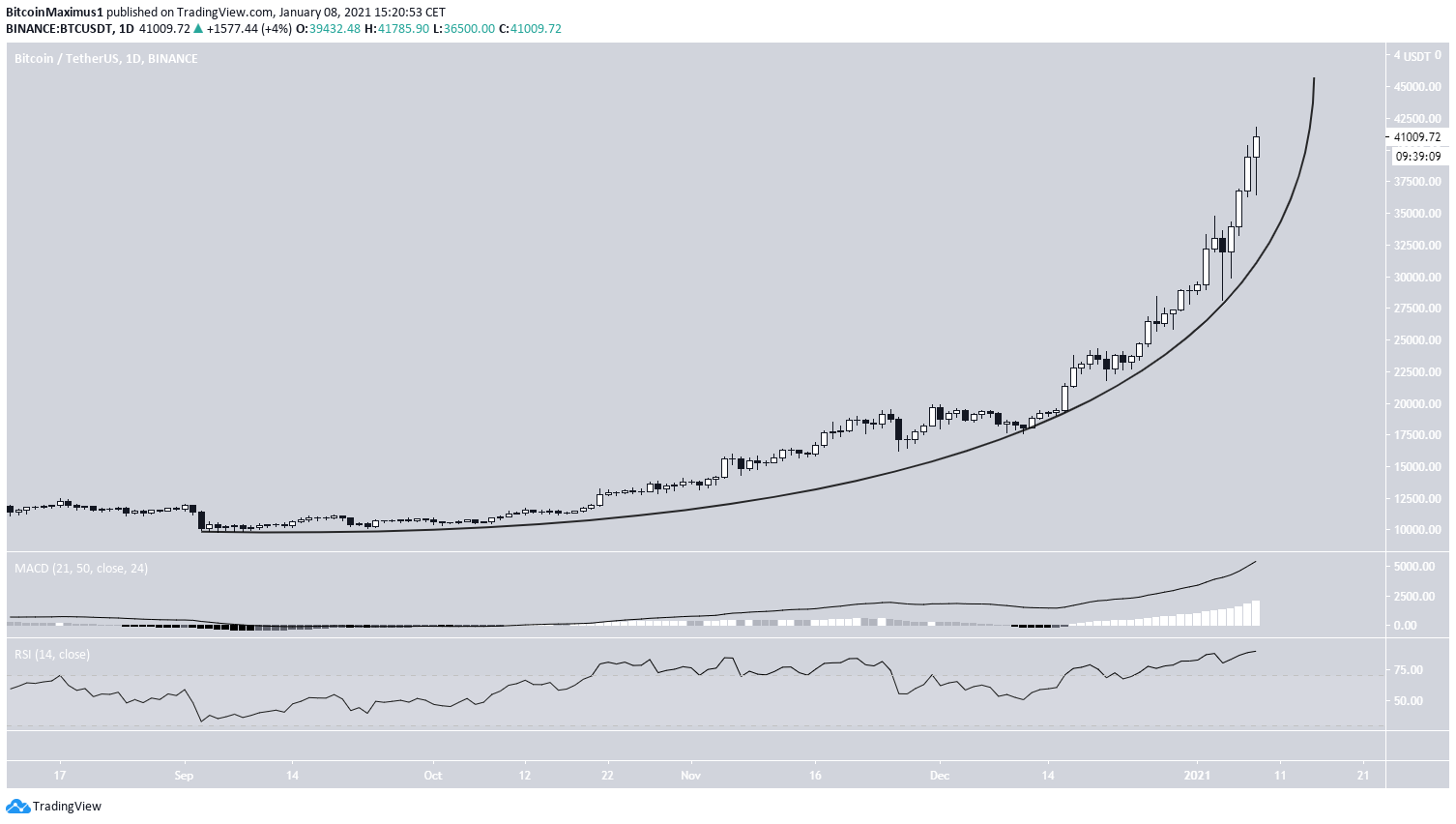

Bitcoin has been increasing rapidly since the beginning of Sept. moving upwards in a parabolic line. Until now, it has reached a high of $41,785, which is the current all-time high price. This marks a more than 400% increase from the Sept lows of $9850. While the rally is definitely overextended, as is visible by the overbought levels in the RSI, there is no definite sign of weakness yet that would confirm the move is coming to an end. Nevertheless, a parabolic rate of increase is unsustainable in the long-run, and the wave count suggest a high between $42,000-$46,000 before a significant correction.

Click here to join the FREE telegram group

Important Highs and Lows

| Highs | Lows |

| $1177.19 – November 30, 2013 | $163.88 – January 14, 2015 |

| $783.93 – June 18, 2016 | $198.38 – August 25, 2015 |

| $19,764.21 – December 17, 2017 | $3148.33 – December 15, 2018 |

| $13,831.25 – June 26, 2019 | $3850 – March 13, 2020 |

Previous Market Cycle Comparison

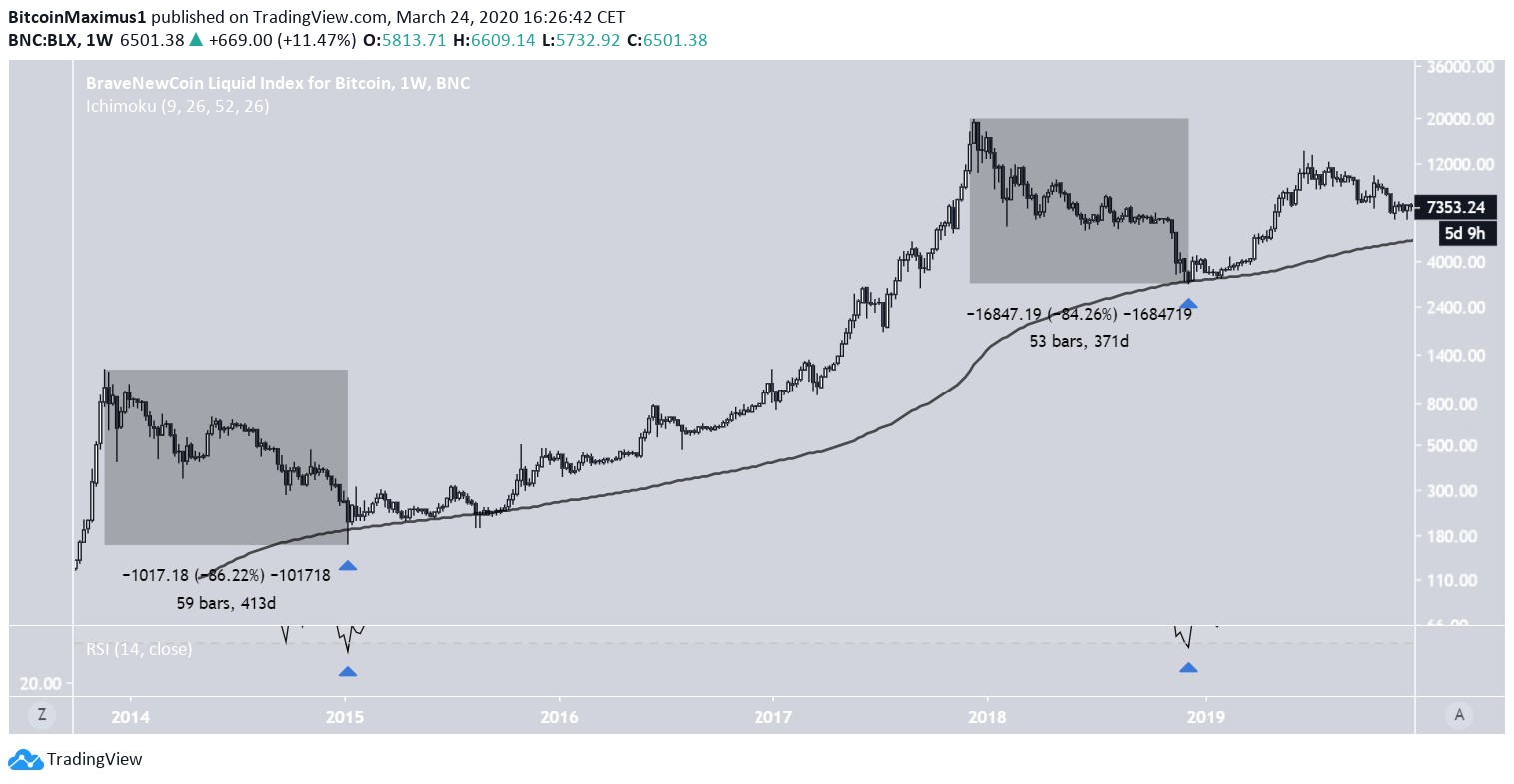

In order to make long-term predictions, we need to make a comparison between the current market cycle and previous ones. There are definite similarities between the downward movement following the $1,177.19 high on November 30, 2013, and the follow-up high of $19,764 high on December 17, 2017. More specifically, the amount of time it took for the price to reach a low and the magnitude of decrease from the high to the low are eerily similar. The price reached a low of $163.88 on January 14, 2015. This occurred 410 days after the previous high and marked a total decrease of 86%. After the December 2017 high, the price reached a low of $3,148.3 on December 15, 2018. This occurred 371 days after the previous high and marked a decrease of 84%. Using technical indicators, we can see even more similarities between the two moves:- January 13, 2014, and December 15, 2018 lows are the only dates in which the weekly RSI fell below 30.

- Finally, both these lows caused the price to touch the 200-week moving average (MA). Therefore, it would make sense if these two lows marked similar points in their respective market cycles.

2020 Halving

Another less-complicated but less-accurate method to make a prediction would be to look at the rate of increase after the halvings, since the third one is projected to occur in May 2020. After the second halving, the BTC price increased by 93% in 231 days, which is the number of days from the projected date of the third halving until the last day of 2020. The issue with this method is that we do not know what the price will be on the halving date. However, considering the 93% increase, a price of $7,500 on halving would give a $14,800 price at the end of the year, fitting with our previous prediction.

Alternate Prediction

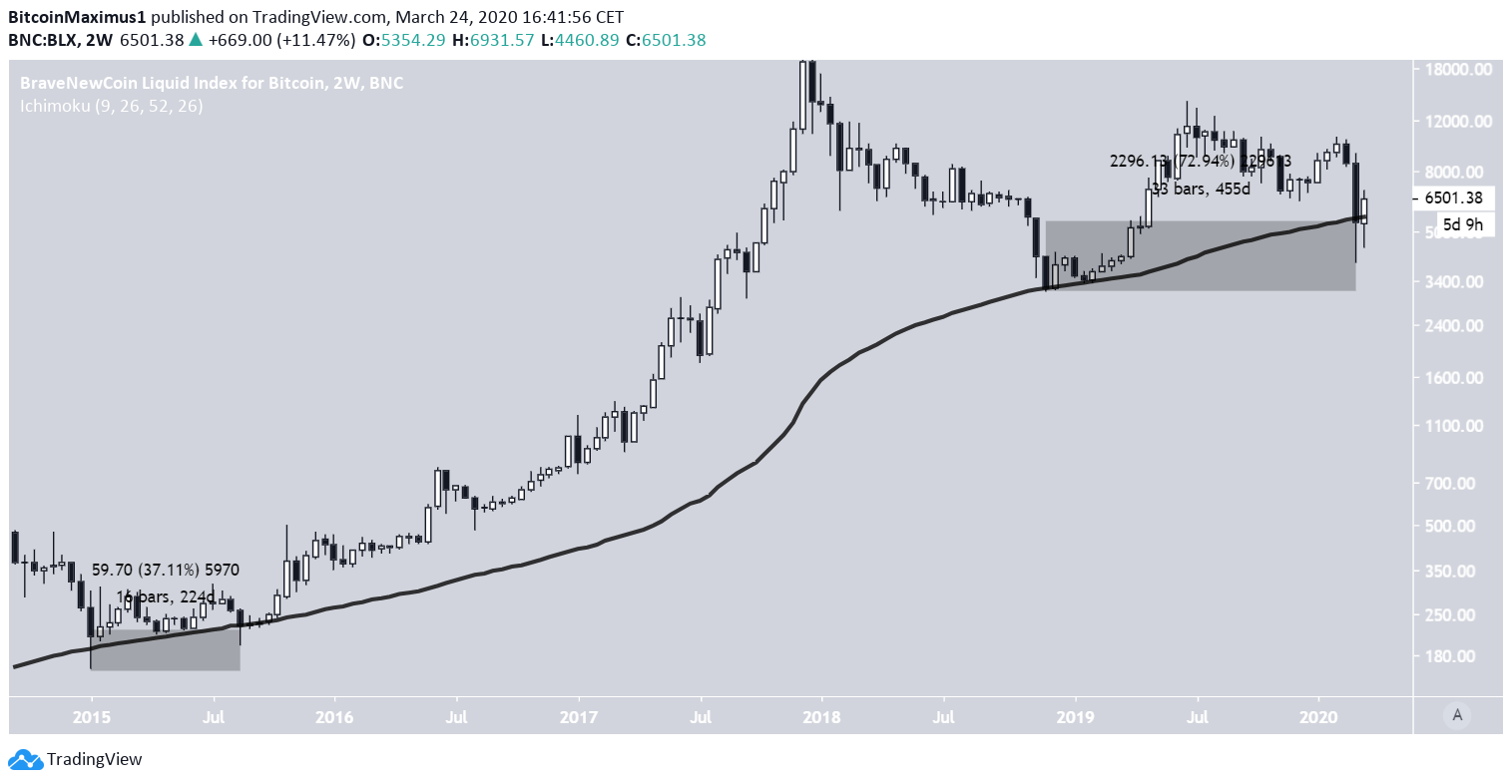

A more bearish prediction suggests that the March 13, 2020, low coincides with that in January 2015, instead of that in August 2015. This is not supported by the RSI but is supported by the fact that there was a very long lower-wick that decreased below the MA. Furthermore, the price movement does not completely support this comparison, since the December 2018 bottom is lower than the current one. This prediction makes the assumption that both the movement and the rate of increase are twice as low in 2020. In this case, the price has yet to begin a bullish trend, since it will make a type of double-bottom, similar to what the price did in August 2015.

Bitcoin Price Prediction 2020

For December 31, 2020, we arrived at a different price with each method, $14,500 and $8,400 respectively. The principal method suggests the price will continue to increase inside a gradual upward trend and eventually reach $14,500. The alternate method (dashed), has a similar movement in the beginning, but the price is expected to decrease initially, before bouncing and reaching $8,400.

Bitcoin Price Prediction 2021

The movement in 2020 has made us adjust our predictions slightly. The reason for this is the faster than expected rate of increase after the second touch of the 200-week MA (shown in black below). Therefore, the fact that the movement in between the two touches of the MA was much slower in 2018 than 2015, that was not a sign that the upward trend in 2018 is slower, but only a sign that it is lagging. This was evident in the identical times it took both movements to reach an all-time high. After the first touch of the MA on January 2015, it took BTC 721 days to reach a new all-time high, which was an increase of 633%. After the first touch of the MA on March 2018, it took BTC 728 day to reach a new all-time high, which was an increase of 630%. Therefore, we can assume that the movement after the March 2018 low coincides with that after the January 2015 low at the same rate of increase and period of time, rather than being twice slower as we previously hypothesized.

Five-Year Bitcoin Price Prediction

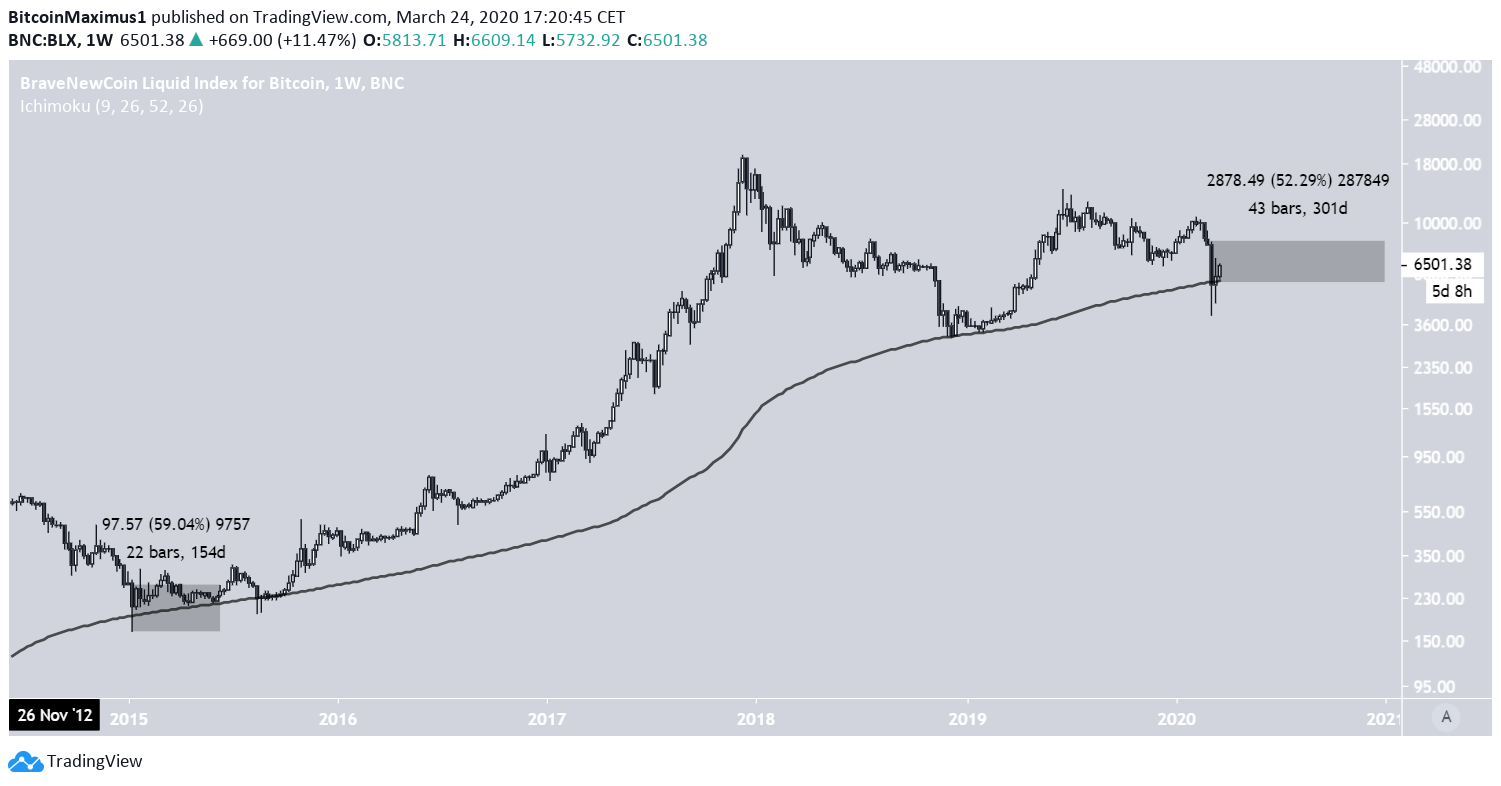

In order to make a prediction for the Bitcoin price five years in advance, we will compare the rate of increase and time periods between each high in the existing market cycles. There have been three main upward moves from Bitcoin’s inception until now. The time it took for the price to move from the first to the second high was 884 days, and the price increased by 3,514%. The movement from the second to the third high took 1,491 days, and the price increased by 1,641%. Therefore, the second move was 1.68 times slower and 0.46 times as large. Using these ratios for predicting the possible next move, the high will be reached 2,514 days after that in December 2017 and will be 766% higher. Using this method, we arrive at a high of $160,000 in December 2024.

| Date | Main Prediction | Alternate Prediction |

| December 31 2020 | $14,500 | $8400 |

| December 31 2021 | $230,000 | $12,600 |

| December 31 2024 | $160,000 | |