Randy Frederick still doesn’t appear completely convinced of Bitcoin’s utility. Nevertheless, the Charles Schwab research frontman couldn’t help referring to it as more of a “mainstream investment.”

Frederick is the Vice President of Trading and Derivatives at the Schwab Center for Financial Research. He appeared on a Yahoo Finance segment on Wednesday, December 16.

Apart from some standard questions surrounding equities and the ongoing Federal Open Market Committee meeting, Frederick couldn’t escape a take on the current BTC rally.

Yahoo anchor Julie Hyman asked whether a pullback in equities would affect the leading crypto in any way:

“Bitcoin’s a tough one because again, there’s no CEO, no board of directors, there’s no dividends, no revenues. It’s kinda like a precious metal in many ways.”

Bitcoin Heavily Outperforming Gold

Bitcoin is powering ahead into the $20,000 a coin range, and gold looks to be in trouble. According to the latest ratio chart, it now costs just over 11 ounces of gold per one BTC:

Indeed, British asset management firm Ruffer LLP yesterday announced that it had reduced its notable investments in gold and bonds to take adequate positions in bitcoin.

With increased buying from institutional players in recent months, Frederick, like other market commentators, relented to the current narrative:

“One of the things I think that has helped Bitcoin a lot recently is that it has received some pretty solid endorsements from very long-term, very experienced and successful hedge fund managers and others…”

The Youth Revolution

Despite a growing wealth gap between young and older investors, the crypto market has thus far largely been driven by a tech-savvy youth.

Charles Schwab has even been copying Bitcoin’s fractional trading model in an effort to attract a younger market. Frederick reiterated this idea in the segment:

“…people in my demographic are uncomfortable with the idea of transacting in a currency that isn’t really controlled by a bank or a central government because if something goes wrong, what do you do?”

Reactions to the interview were not unsurprising. Controversial Bitcoin maximalist Udi Wertheimer chimed in with some choice words:

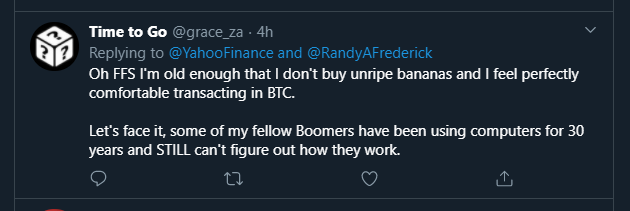

While others felt that age shouldn’t even be a factor by now: