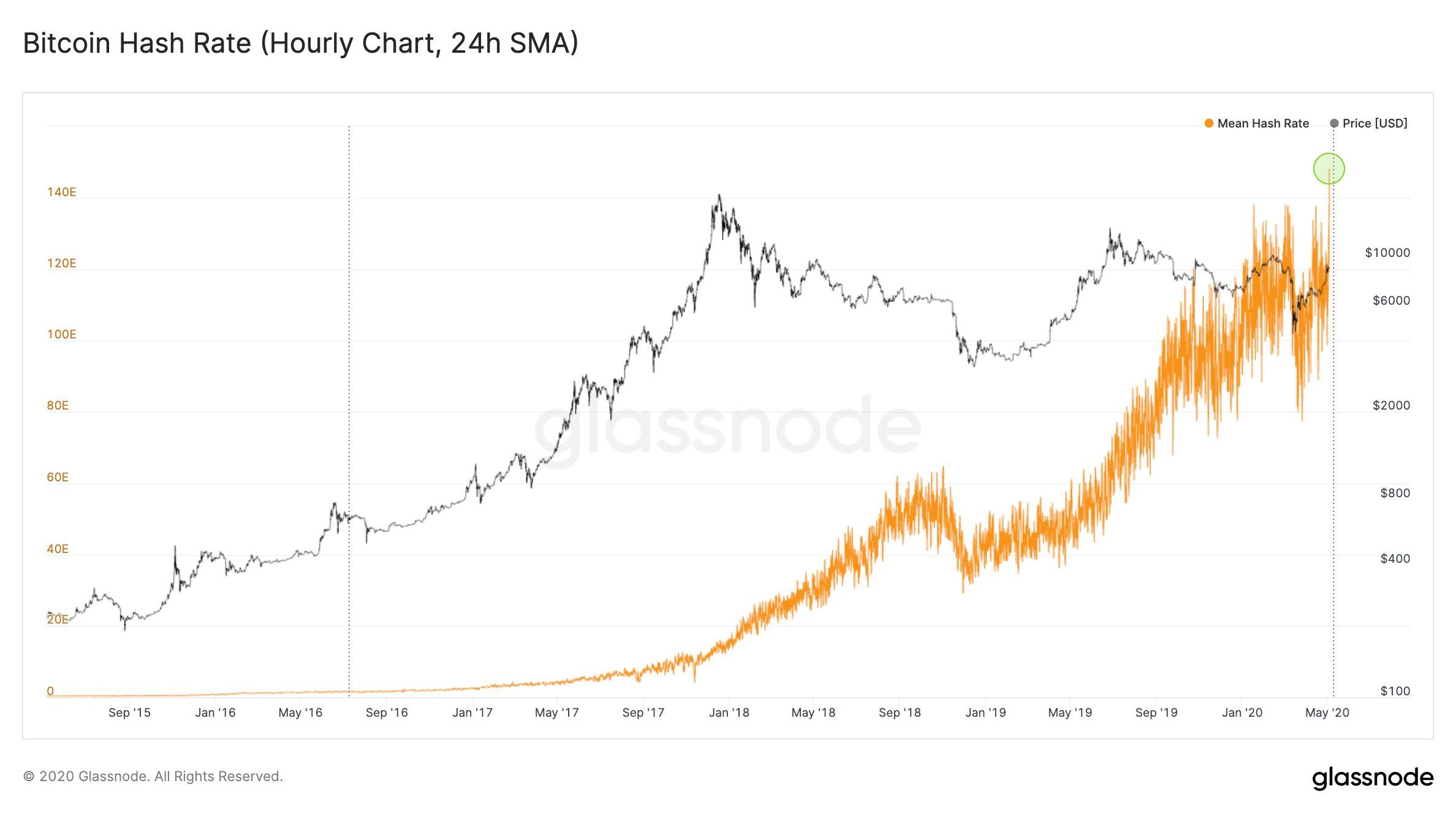

Bitcoin’s hash rate momentarily reached an all-time high of 140 Eh/s during trading on Sunday. However, the rate dropped sharply thereafter falling back to 131 Eh/s, under the previous ATH of 135 Eh/s on April 14.

Each block of Bitcoin transactions is generated when a computer solves a complex equation generated by the network.

The hash rate represents the number of attempted solutions to that equation used.

Bitcoin’s Hash Rate Indicator

A greater number of ‘hashes’ indicate greater levels of activity by miners on the network. Increases in network activity are generally indicative of increased levels of adoption and widespread use.

Because Bitcoin’s functionality is based on consensus, increased levels of adoption could indicate price increases. A quick perusal of the comments in the Twitter link above reveals the hopes of the Bitcoin community based on the hash rate.

However, the number of attempted solutions on the network is not necessarily indicative of price changes. In fact, as the halving approaches, the number of miners seeking to generate blocks at the higher reward could be the cause of the uptick in hashrate.

Post-Halving Trajectory

While no single spike in hash rate may be indicative of price increases, the trajectory of the hash rate increases is a positive sign for the network as a whole. A comparison of the price and hash rate reveals that they do actually appear to be more in sync than during previous price increases.

However, as the mining rewards decline after the upcoming halving, many miners may close up shop. Lower rewards will leave miners more dependent on transaction fees — smaller sums when compared to current block rewards.

This activity could well drive miners to sell off their smaller block rewards to maintain business. Called ‘capitulation,’ some fear this activity will result in a flood of Bitcoin supply into the market, causing a severe decline in prices.