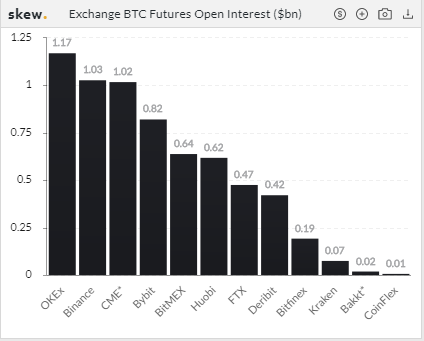

The total value of open interest in bitcoin futures on the Chicago Mercantile Exchange (CME) has exceeded $1 billion as investment interest continues to grow rapidly.

This was revealed on Nov 18 in a tweet by crypto trading analytics firm Skew. Aggregated open interest figures for bitcoin futures hit $1.02 billion on the CME.

This figure represents a new all-time high open interest value for bitcoin and highlights the speed of investment growth in 2020, more than doubling the $500 million all-time high recorded in May.

CME #bitcoin futures just crossed $1bln open interest pic.twitter.com/VLx4tL85zw

— skew (@skewdotcom) November 18, 2020

Significance of Aggregate Open Interest in Bitcoin Futures

Open interest is a trading metric that measures the total number of outstanding futures contracts that are yet to be settled. It provides a more accurate picture of market activity for an asset’s contracts by counting the total number of open contracts, effectively measuring investor interest.

In May 2020, BeInCrypto reported that the total number of open interest bitcoin futures nearly doubled in just two weeks from 6,000 to more than 10,000 contracts. This came in the same month that the total value of open interest bitcoin futures rose to a new all-time high of $500 million.

I do not profess to be a bitcoin expert in any sense. But I shared this interesting chart in my Daily Edition this evening. https://t.co/67VxUKqXpD. Total open interest in bitcoin futures has nearly doubled in the past 2 weeks. Something interesting is brewing. pic.twitter.com/jwoQ3vbBLN

— Tom McClellan (@McClellanOsc) May 16, 2020

While open interest is generally not regarded as a useful predictor for price movements, it’s generally accepted as a useful way of gauging investor interest.

Gateway for Institutional Investment

Perhaps the most important implication of the CME’s open interest stats is the institutional involvement in the space. The CME now competes closely with OKEx to become the world’s largest bitcoin derivatives marketplace.

Launched in 2017, the CME’s bitcoin futures market serves as the de-facto gateway for institutional investment into bitcoin. Some argue that the data suggests bitcoin’s latest bull run is driven largely by institutional money.

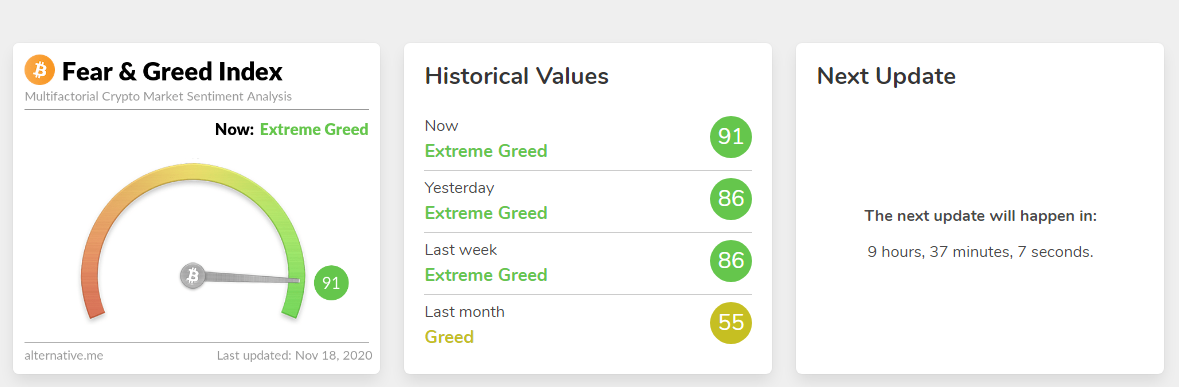

Bitcoin continues its historic surge to price levels not seen since late 2017, with the price topping $18,000 on Nov 18. The Crypto Fear & Greed Index now has a reading of around 90, signifying “Extreme Greed.”

For context, the highest reading ever achieved on the index was 95, which took place in June 2019 at a price level of just over $13,000.