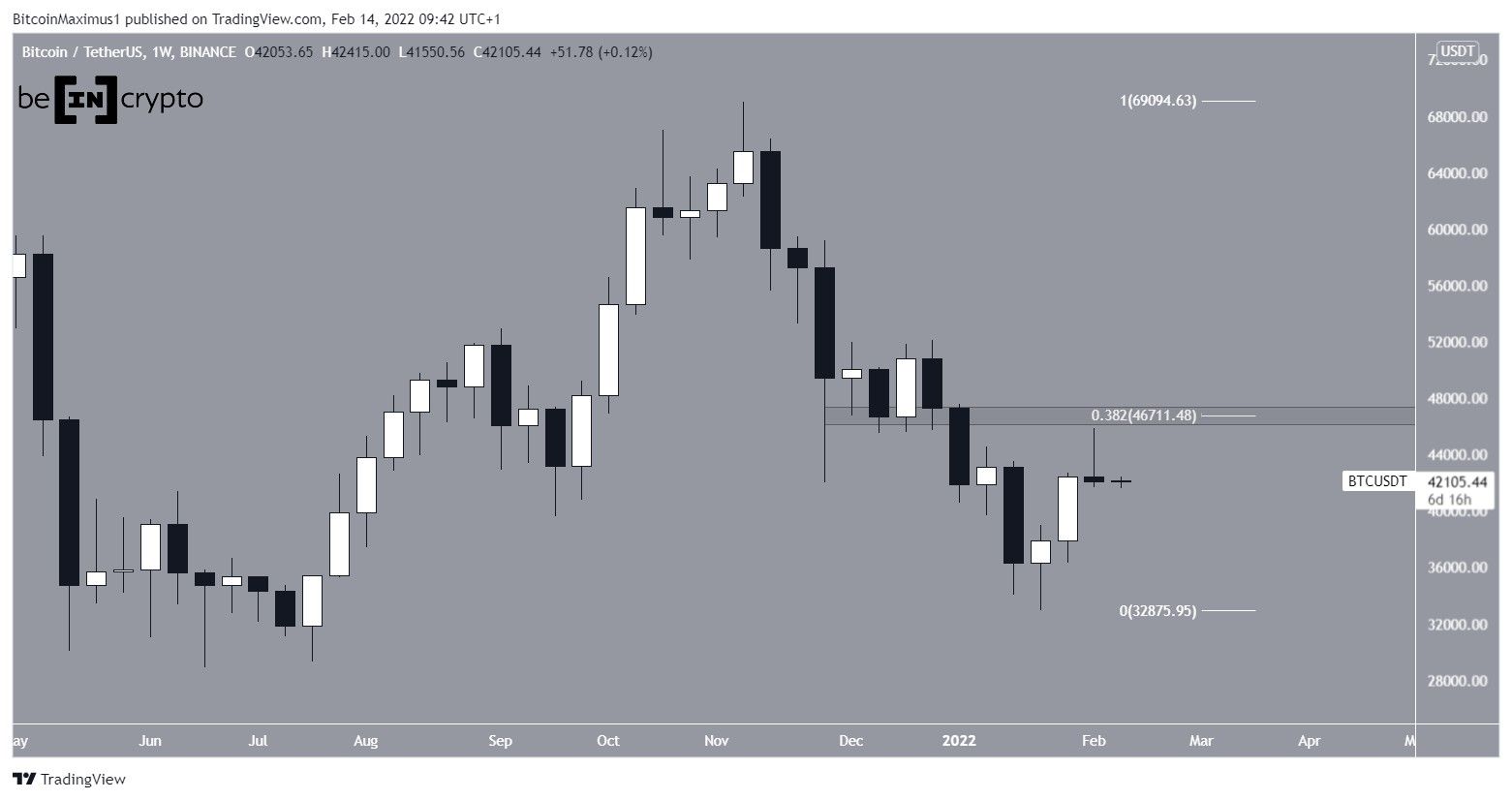

Bitcoin failed to close the week of Feb 7-14 on a positive note, creating a candle with a long upper wick instead. However, the short-term readings suggest a reversal could soon occur.

After creating a bullish candlestick during the week of Jan 31-Feb 6, BTC decreased slightly the next week, creating a bearish candlestick with a very long upper wick.

When measuring the entire downward movement, the $45,821 local BTC high is very close to the 0.382 Fib retracement resistance level at $46,700, which is also a horizontal resistance area.

Therefore, it’s likely to act as the main resistance level now.

Technical indicators

The daily chart shows that BTC was rejected by the 0.618 Fib retracement resistance level (red icon) when measuring the most recent portion of the downward move. This resistance is found at $44,900.

Technical indicators are showing some bullish signs. This is especially visible in the RSI, which has moved above the 50-line. This line is considered a threshold for whether the trend is bullish or bearish.

Similarly, the MACD is moving upwards but is not yet positive. This would be another sign that the trend is bullish.

The six-hour chart shows that BTC has fallen back inside an ascending parallel channel. Previously, the channel contained the movement from Jan 24, until it broke out on Feb 8.

Currently, BTC is trading right at the midline of the channel, which is expected to provide support.

Unlike the daily time frame, both the MACD and RSI provide neutral readings.

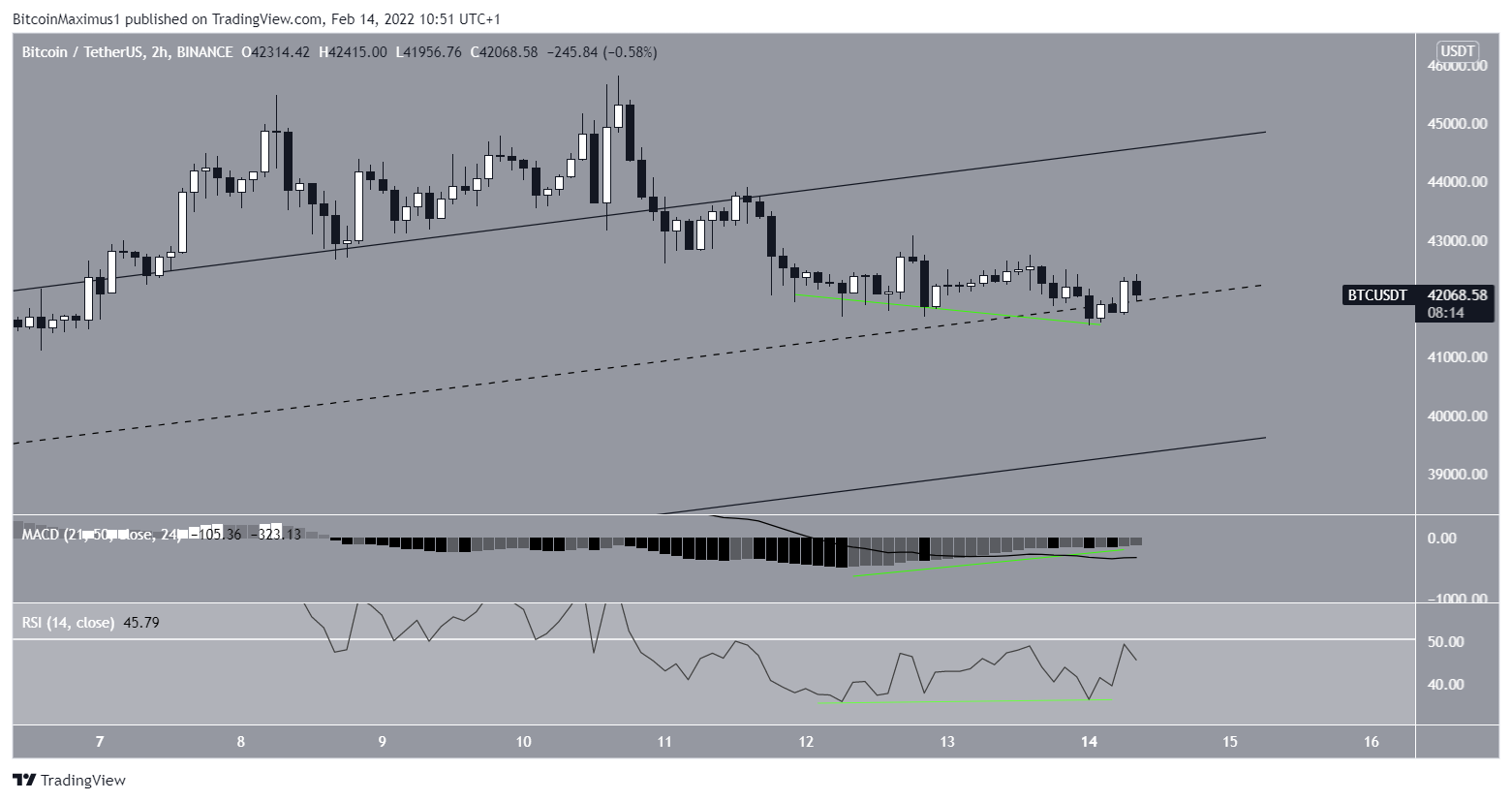

The two-hour chart is a bit more bullish.

Besides trading right in the middle of the channel, both the RSI and MACD have generated considerable bullish divergences (green line). This is an occurrence that often precedes strong upward moves.

BTC wave count analysis

The most likely long-term wave count indicates that BTC has already reached a bottom. The short-term count (red) suggests that BTC has completed wave four of a five-wave upward pattern. The sub-wave count is shown in black.

The Feb 14 low was made right at the 0.5 Fib retracement level when measuring the entire wave three (white) and gave sub-waves A and C a 1:1.61 ratio, a suitable level for a low to be reached.

If wave five has begun, the most likely target for the top of the is estimated between $47,625 and $47,912. This range is found by projecting the length of wave one and using an external retracement on wave four.

After this, BTC could correct in the short/medium term.

BeInCrypto’s previous Bitcoin (BTC) analysis, click here