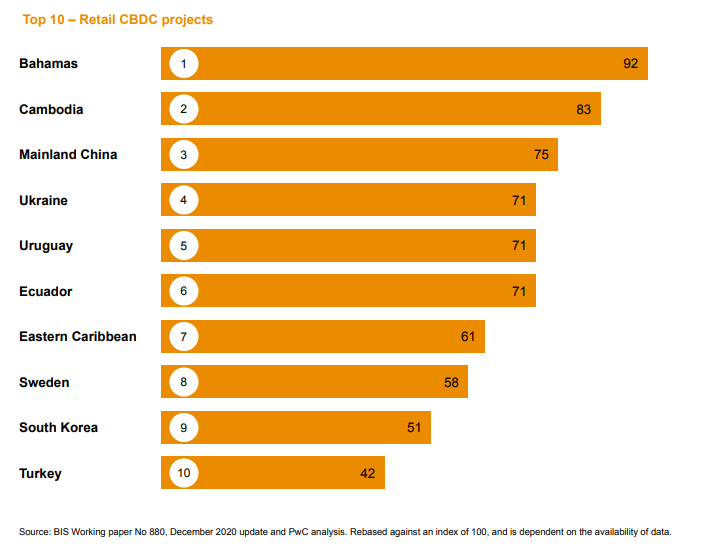

The Bahamas and Cambodia rank as the top two CBDCs in a new report, owing to their official launches. China’s much-discussed digital yuan ranks third.

Professional services firm PwC has given the Bahaman Central Bank Digital Currency (CBDC) the highest rank in a new report. The Caribbean island tops even China’s digital yuan, which is widely thought to be the most progressed CBDC.

The report notes that over 60 countries are examining the use of CBDCs, which are essentially just blockchain-based versions of fiat currencies.

The Bahaman Sand Dollar is followed by Cambodia’s Project Bakong, both of which are given high scores because they are already live. It notes that 70% of wholesale projects are running pilot programs, while 23% have reached the implementation stage.

Speaking about the benefits of CBDCs, Partner Financial Services Risk, and Blockchain PwC France & Maghreb, Benoît Sureau said:

“CBDCs will be a game-changer, providing access to alternative payment solutions for citizens and corporates, as well as reinventing financial market settlement and interbank monetary transactions.”

China comes third, followed by Ukraine, Uruguay, and Ecuador. As is clear, the highest-ranking CBDCs come from developing economies. Also, PwC states that “financial inclusion and digitization appear as key drivers” for these countries.

Additionally, China’s digital yuan has already undergone several pilot programs in several major cities. The country’s central bank airdropped the token to randomly selected citizens for use at stores.

China is already a digital payment first nation, and the CBDC is a natural evolution of that strategy. The US appears concerned that it could challenge the dominance of the US dollar. The US itself has not revealed much in the way of CBDC plans.

CBDCs moving forward at a rapid pace

The development of CBDCs has spurred both support and criticism from within the market. Some see it as a necessary step towards mainstream adoption, while others have disapproved of the centralized control. The criticism largely focuses on the fact that CBDCs do not really avoid the issues of fiat currencies.

With over 60 countries now considering CBDCs, the stage is set for blockchain to entrench modern society. As noted by the report, linking these with retail projects could greatly expand the scope.

The end goal of this is that citizens should have quicker, cheaper, and more fraud-proof means of exchanging money. However, a few years before this happens, even the most advanced CBDCs are not expected to launch in the short term officially.